Forecasting – Simple moving average – Example 1

Trending full videos relevant with Forex Signals, Forex Indicators, Stock Trends, and Sma Trading Term, Forecasting – Simple moving average – Example 1.

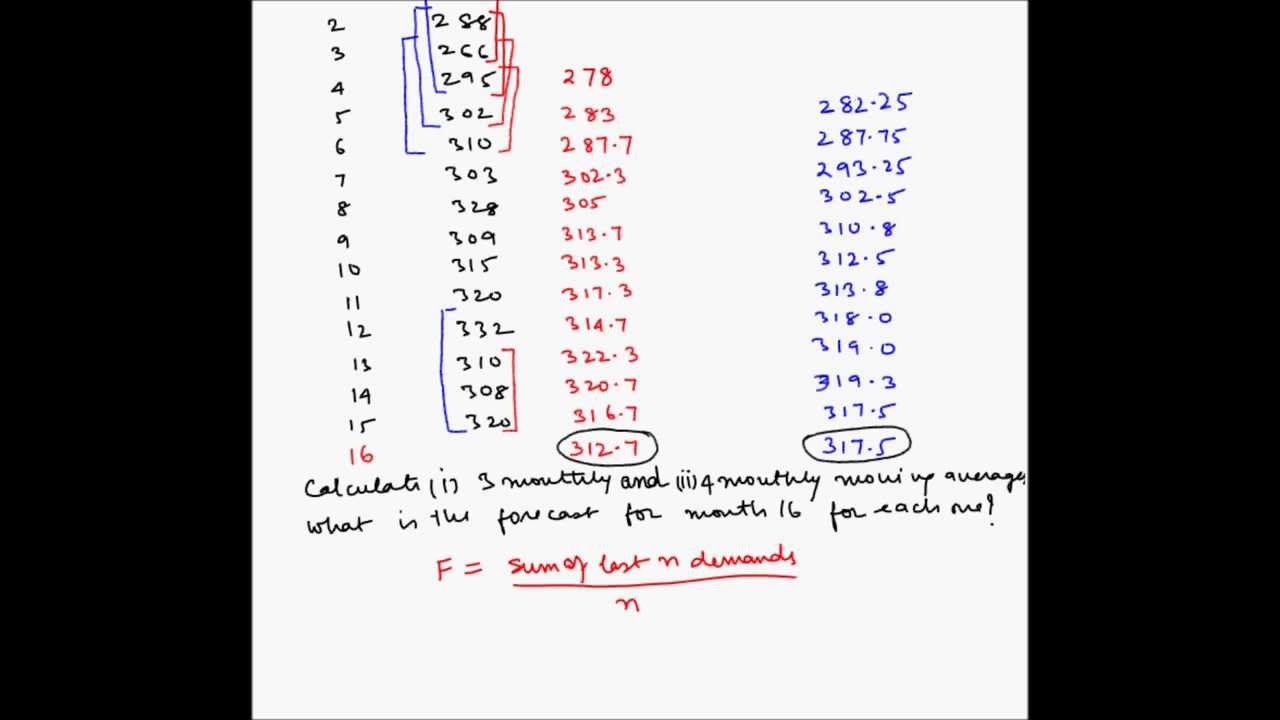

In this video, you will learn how to find out the 3 month and 4 monthly moving average for demand forecasting.

Sma Trading Term, Forecasting – Simple moving average – Example 1.

Trading The Forex Market – What Are The Best Forex Trading Indicators?

There’s plenty out there, however we only recommend one. Another example of a simple timing system might be expressed as follows. Volume is among the most crucial indications to search for.

Due to the fact that they are lagging signs.

Forecasting – Simple moving average – Example 1, Get top full videos related to Sma Trading Term.

Trend Following Forex – 3 Basic Actions To Capturing Huge Profits

Support and resistance are levels that the market reaches prior to it reverses. You make 10% earnings and you offer up and get out. I choose to hold things that are rising in value. Ensure you become one of that minority.

Would not it be nice if you were only in the stock market when it was going up and have everything transferred to cash while it is going down? It is called ‘market timing’ and your broker or financial coordinator will inform you “it can’t be done”. What that individual just informed you is he doesn’t know how to do it. He does not understand his task.

Utilizing the very same 5% stop, our trading system went from losing practically $10,000 to acquiring $4635.26 over the very same ten years of data! The performance is now a positive 9.27%. There were 142 profitable trades with 198 unprofitable trades with the Moving Average Trader profit being $175.92 and average loss being $102.76. Now we have a better trading system!

Nasdaq has rallied 310 points in three months, and hit a new four-year high at 2,201 Fri morning. The economic information suggest market pullbacks will be limited, although we’ve gone into the seasonally weak duration of Jul-Aug-Sep after a huge run-up. Subsequently, there may be a consolidation period instead of a correction over the next few months.

The reality that the BI is examining such a helpful period suggests that it can typically figure out the bias for the day as being bullish, bearish, or neutral. The BI represents how the bulls and bears establish their initial positions for the day. A move far from the BI indicates that a person side is stronger than the other. A stock moving above the BI means the dominating belief in the stock is bullish. The Forex MA Trading in which the stock breaks above and trades above the BI will show the strength of the bullish sentiment. The opposite but very same analysis uses when a stock moves listed below its BI.

Instead of subscribing to an advisory letter you Stocks MA Trading decide to make up your own timing signal. It will take some initial work, once done you will not need to pay anybody else for the service.

One of the finest ways to burglarize the world of journalism is to have a specialism or to develop one. If you are enthusiastic about your subject then you have a chance of communicating that interest to an editor. Whether this is bee-keeping or the involved world of forex trading if you have the understanding and know-how then ultimately may be looked for for your remarks and opinions.

Believe of the MA as the same thing as the cockpit console on your ship. Moving averages can inform you how fast a pattern is moving and in what instructions. Nevertheless, you may ask, what exactly is a moving typical indicator and how is it determined? The MA is exactly as it sounds. It is approximately a number of days of the closing price of a currency. Take twenty days of closing prices and determine an average. Next, you will chart the current price of the marketplace.

To help you determine patterns you must likewise study ‘moving averages’ and ‘swing trading’. For example two standard rules are ‘do not buy a stock that is below its 200-day moving typical’ and ‘do not buy a stock if its 5-day moving average is pointing down’. If you don’t comprehend what these quotes imply then you need to research study ‘moving averages’. Excellent luck with your trading.

Nasdaq has been creating an increasing wedge for about two years. They do not know correct trading strategies. Now that you’ve tallied the points, what does it indicate? It routes the cost action and constantly lags behind it.

If you are searching exclusive engaging videos about Sma Trading Term, and Options Trading System, Demarker Indicator, Stock Market for Beginners, Swing Trading Strategy dont forget to list your email address our newsletter totally free.