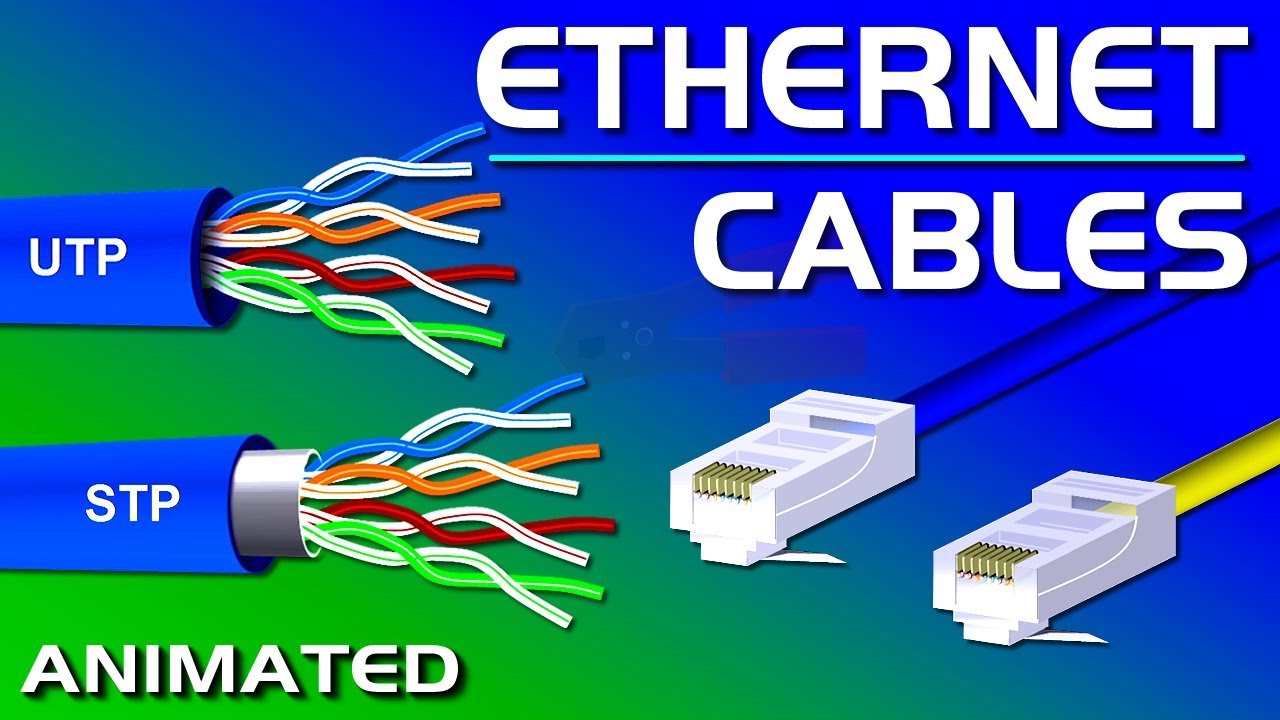

Ethernet Cables, UTP vs STP, Straight vs Crossover, CAT 5,5e,6,7,8 Network Cables

Popular reviews top searched What Are the Best Indicators to Use, Market Rally, Counter Trend Trade, and What Is Ma 5 Crossover 10, Ethernet Cables, UTP vs STP, Straight vs Crossover, CAT 5,5e,6,7,8 Network Cables.

This is an animated video explaining Ethernet network cables, such as unshielded twisted pair (UTP) and shielded twisted pair (STP). Straight (patch ) cables vs …

What Is Ma 5 Crossover 10, Ethernet Cables, UTP vs STP, Straight vs Crossover, CAT 5,5e,6,7,8 Network Cables.

Online Stock Trader Ideas – Discipline And Tape Reading

Likewise active trading can impact your tax rates. Personally, I believed that promoters of such a FX trading system had lots of crap! You can use any indications that you’re comfy with to go through a comparable procedure.

Ethernet Cables, UTP vs STP, Straight vs Crossover, CAT 5,5e,6,7,8 Network Cables, Find interesting full videos related to What Is Ma 5 Crossover 10.

Trading Strategies Of The Professionals

A technique that is fairly popular with traders is the EMA crossover. Comparing the closing price with the MA can help you figure out the trend, among the most important things in trading. Oil had its largest percentage drop in three years.

In my earlier articles, we have actually learnt signs, chart patterns, finance and other pieces of successful trading. In this post, let us evaluate those pieces and puzzle them together in order to find conditions we choose for getting in a trade.

But if you have a number of bad trades, it can truly sour you on the entire trading game Moving Average Trader .This is when you simply need to step back and take a look at it. Perhaps, you just need to escape for a day or 2. Unwind, do something various. Your unconscious mind will work on the problem and when you come back, you will have a much better outlook and can find the trading opportunities much faster than they can come at you.

Technical Analysis uses historic rates and volume patterns to forecast future habits. From Wikipedia:”Technical analysis is frequently contrasted with basic Analysis, the research study of economic factors that some analysts say can affect rates in monetary markets. Technical analysis holds that costs currently show all such impacts before financiers know them, for this reason the research study of rate action alone”. Technical Experts strongly believe that by studying historic rates and other essential variables you can anticipate the future rate of a stock. Absolutely nothing is outright in the stock exchange, but increasing your likelihoods that a stock will go the direction you expect it to based upon cautious technical analysis is more precise.

“This easy timing system is what I utilize for my long term portfolio,” Peter continued. “I have 70% of the funds I have actually allocated to the Stock Forex MA Trading invested for the long term in leveraged S&P 500 Index Funds. My investment in these funds forms the core of my Stock portfolio.

Throughout these times, the Stocks MA Trading regularly breaks assistance and resistance. Naturally, after the break, the costs will normally pullback prior to continuing on its way.

As bad as things can feel in the precious metals markets nowadays, the reality that they can’t get too much worse needs to console some. Gold especially and silver are looking excellent technically with gold bouncing around strong support after its second run at the age-old $1,000. Palladium seems holding while platinum is anybody’s guess at this point.

Using the moving averages in your forex trading service would show to be really beneficial. Initially, it is so easy to utilize. It is presented in a chart where all you have to do is to keep a keen eye on the very best entrance and exit points. If the MAs are going up, thats a sign for you to start purchasing. Nevertheless, if it is going down at a constant pace, then you need to start offering. Being able to check out the MAs right would definitely let you understand where and how you are going to make more money.

Always know your feelings and never ever make a trade out of fear or greed. This is harder than it seems. A lot of amateur traders will pull out of a trade based upon what is taking place. However I ensure you this is always bad. To generate income regularly you should develop a strategy and stick with it. So be it if this implies setting targets and stops and leaving the room! This might be more difficult to practice than it sounds however unless you get control of your feelings you will never be a successful trader.

From my perspective, I see $33 as a level I may meticulously start to buy. In reality, the last time the 30-day moving typical crossed under the 90-day moving average remained in August of in 2015.

If you are looking rare and engaging videos about What Is Ma 5 Crossover 10, and Pivot Point Trading, Ema Indicator dont forget to list your email address our newsletter for free.