EMA 20/50/100/200 Strategy | 200 EMA trading strategy

Top full videos related to International Trading, Stock Trading System, and Ema Trading Strategy, EMA 20/50/100/200 Strategy | 200 EMA trading strategy.

Hello Friends,

We are going to learn EMA 20/50/100/200 strategy in this video. This strategy is also know as 200 EMA trading strategy.

You can use this strategy in any timeframe. In this strategy you will learn how to enter into any stock, where to place stop loss, where to take profits, how to manage the trade, etc…

Hope you will like the video…

Keep learning and growing.

#stockmarket #intraday #swingtrading #positionaltradingstrategy #trading #stocks #stocktrading #movingaverage #trading #share #sharemarket #money #trader #investing #investment #invest #nifty #banknifty

Ema Trading Strategy, EMA 20/50/100/200 Strategy | 200 EMA trading strategy.

Developing The Very Best Forex Trading Strategy

Because they are lagging indications. My favorites are the 20-day and the 50-day moving averages on the S&P 500 index (SPX). So lots of people have actually been trading this market wrong.

EMA 20/50/100/200 Strategy | 200 EMA trading strategy, Watch interesting reviews about Ema Trading Strategy.

Forex Earnings – Two Basic Indications Anyone Can Utilize To Improve Trading

The technical analysis should likewise be determined by the Forex trader. The price didn’t quite make it, closing at $11.83 on the day of expiration (point 7). The green line illustrates the significant battle location for $1,000.

If you have actually been in currency trading for any length of time you have heard the following 2 expressions, “trend trade” and “counter trend trade.” These two methods of trading have the exact same validity and require just as much work to master. I like trading counter pattern because I have discovered a system that enables me to discover high frequency trades.

3) Day trading suggests fast profit, do not hold stock for more than 25 minutes. You can always sell with profit if it begins to fall from top, and after that purchase it back later if it Moving Average Trader end up going up again.

There are a couple of possible descriptions for this. The first and most apparent is that I was merely setting the stops too close. This might have enabled the random “noise” of the cost movements to trigger my stops. Another possibility is that either my broker’s dealing desk or some other heavy hitter in the market was engaging in “stop hunting”. I have actually composed a more complete post on this subject already, but basically this involves market gamers who attempt to push the price to a point where they believe a great deal of stop loss orders will be triggered. They do this so that they can either get in the market at a much better price for themselves or to cause a snowballing move in an instructions that benefits their existing positions.

Choosing a time frame: If your day trading, buying and offering intra day, a 3 year chart will not help you. For intra day trading you desire to utilize 3,5 and 15 minute charts. Depending upon your longterm investment technique you can look at a 1 year, which I use most frequently to a 10 year chart. The annual chart provide me a look at how the stock is doing now in today’s market. I’ll look longer for historical assistance and resistance points but will Forex MA Trading my buys and offers based on what I see in front of me in the annual.

A Forex trading strategy requires 3 Stocks MA Trading basic bands. These bands are the time frame picked to trade over it, the technical analysis used to identify if there is a price trend for the currency pair, and the entry and exit points.

The most utilized MA figures consist of the 20 Day MA, the 50 Day MA and the 200 Day MA. The 20 Day MA looks at the short term average, the 50 Day looks that a more intermediate timespan and the 200 Day looks at a longer amount of time. The entire purpose for this method is to just be invested when the security is over their moving average. It is ideal when it is over all three averages, but that generally isn’t the case. To keep threats down, I recommend just opting for the 200 Day Moving Average.

As you can see, defining the BI is easy. The 30-minute BI is strictly the high and the low of the very first 30 minutes of trading. I discover that the BI often reveals the predisposition of a stock for the day.

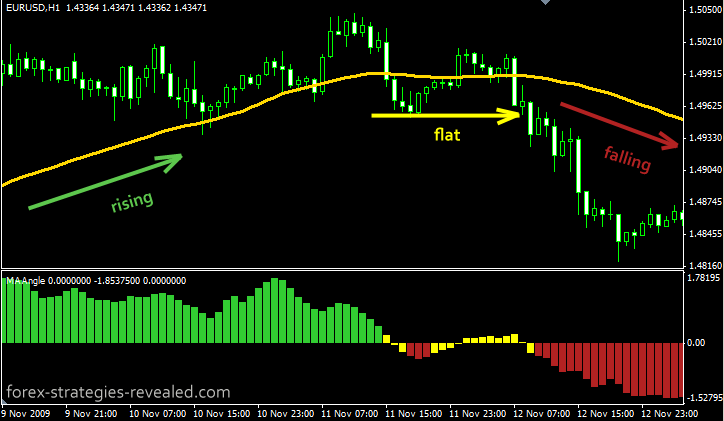

A way to determine the speed or significance of the move you are going to trade versus. This is the trickiest part of the equation. The most typical way is to measure the slope of a MA against an otherwise longer term trend.

Likewise getting in and out of markets although more affordable than in the past still costs money. It is constantly easier to paddle in the direction of the river! Long as the stock holds above that breakout level.

If you are finding most entertaining comparisons relevant with Ema Trading Strategy, and Trading Forex Online, Novice Traders, Trading Time, Forex Trading Software Online dont forget to list your email address our email list for free.