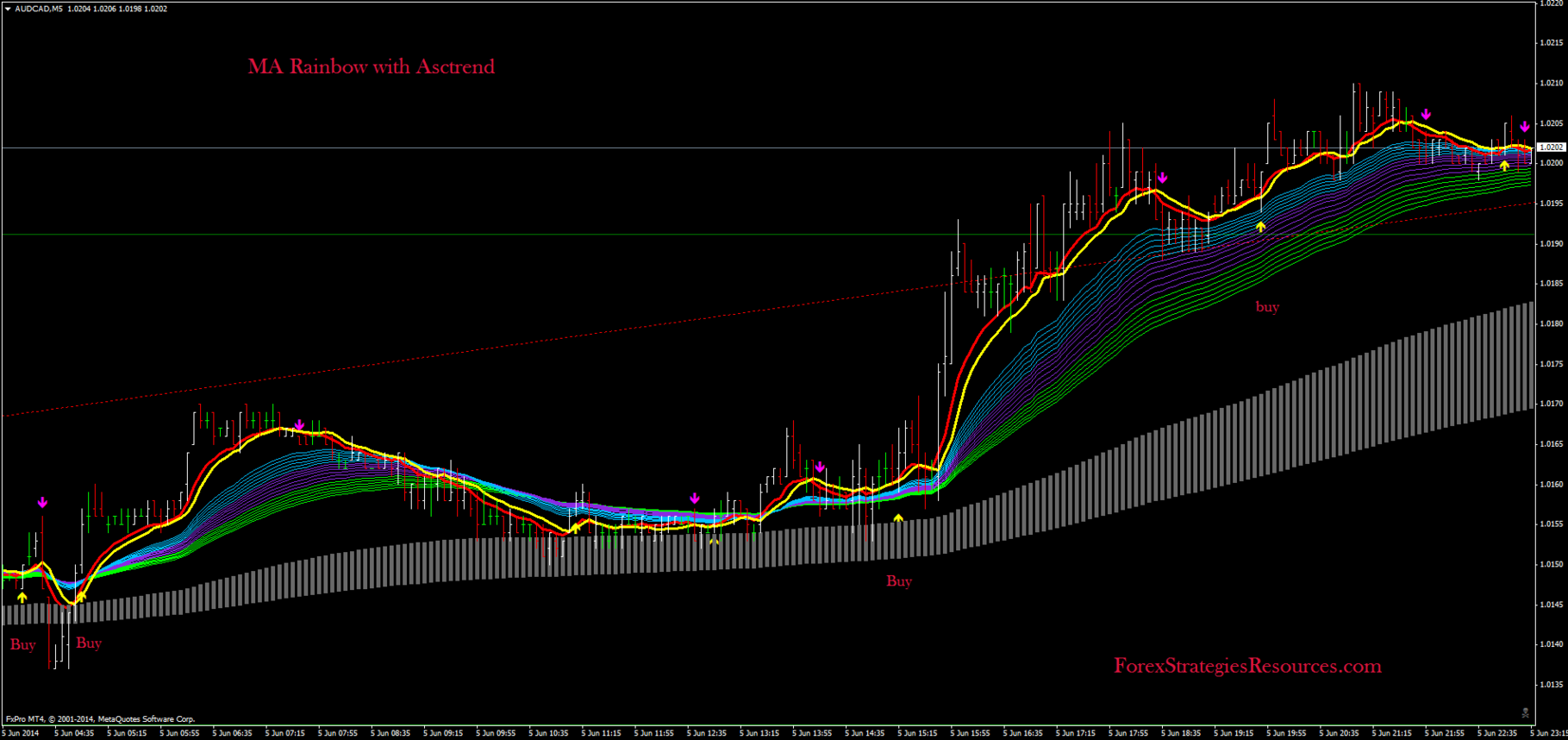

Day trade use sma 50 20 and RSI

Latest guide top searched Trading Stocks, Trade Stocks, Stock Market for Beginners, and How To Use Sma In Trading, Day trade use sma 50 20 and RSI.

How To Use Sma In Trading, Day trade use sma 50 20 and RSI.

My Leading 3 Technical Indications For Trading Stocks Like A Pro

First take a look at the last few days, then the last few weeks, months and after that year. This tool supplies a relative meaning of cost highs/lows in regards to upper and lower bands.

Day trade use sma 50 20 and RSI, Explore latest complete videos about How To Use Sma In Trading.

Forex Trend Following – 2 Ideas To Milk The Huge Patterns For Larger Profits

To the novice, it might appear that forex traders are extremely stressed over pattern trading. Again another fantastic system that no one truly talks about. Let’s begin with a system that has a 50% chance of winning.

You need to understand how to chart them if you trade stocks. Some individuals search through charts to discover buy or sell signals. I find this wasteful of a stock traders time. You can and need to chart all types of stocks including cent stocks. When to purchase or sell, charting tells you where you are on a stocks rate pattern this implies it tells you. There are lots of terrific business out there, you don’t wish to get caught purchasing them at their 52 week high and needing to linger while you hope the rate returns to the price you paid.

“Remember this Paul,” Peter Moving Average Trader said as they studied the long term chart, “Wealth originates from taking a look at the huge picture. Lots of people think that holding for the long term means forever. I prefer to hold things that are increasing in worth.If the trend refuses, I take my cash and wait until the trend shows up again.

Nasdaq has actually rallied 310 points in 3 months, and struck a brand-new four-year high at 2,201 Fri morning. The financial data suggest market pullbacks will be restricted, although we have actually entered the seasonally weak period of Jul-Aug-Sep after a huge run-up. Subsequently, there may be a consolidation duration instead of a correction over the next couple of months.

Assuming you did not see any news, you require to set a Forex MA Trading trade putting style. For circumstances, if you see that the major trend is directed, search for buy signal created from FX signs, and do not even trade to cost this duration. This also uses when you see that the major trend is down, then you understand it is time to buy.

The online Stocks MA Trading platforms use a lot of sophisticated trading tools as the Bolling Bands indicator and the Stochastics. The Bolling Bands is consisting of a moving typical line, the upper requirement and lower standard variance. The most utilized moving average is the 21-bar.

So, when you utilize MAs, they lag behind the cost action and whatever trading signals that you get are always late. This is very important to comprehend. Another constraint with MAs is that they have a tendency to whipsaw a lot in a choppy market. When the market is trending nicely but whipsaw a lot under a market moving sideways, they work well. The much shorter the time period used in an MA, the more whipsaw it will have. Shorter duration MAs move fast while longer duration MAs move gradually.

This is where the typical closing points of your trade are computed on a rolling bases. State you want to trade a hourly basis and you want to plot an 8 point chart. Merely gather the last 8 hourly closing points and divide by 8. now to making it a moving average you move back one point and take the 8 from their. Do this 3 times or more to establish a trend.

Now, this very essential if you change the variety of durations of the basic moving average, you must change the basic deviation of the bands also. For example if you increase the period to 50, increase the basic discrepancy to two and a half and if you decrease the duration to 10, reduce the basic deviation to one and a half. Periods less than 10 do not appear to work well. 20 or 21 period is the ideal setting.

It is invariably used in double format, e.g. a 5 day moving average and a 75 day moving average. In many instances we can, but ONLY if the volume boosts. A sag is shown by lower highs and lower lows.

If you are looking instant entertaining comparisons related to How To Use Sma In Trading, and Forex Trader, Stock Trading Tip, Buying Conditions dont forget to subscribe for subscribers database now.