Complete Guide To Moving Average Trading Strategy

Latest un-edited videos relevant with Day Trading, Trading Indicators, Forex Trading School, and What Happens When 50 Sma Crosses 200 Sma, Complete Guide To Moving Average Trading Strategy.

Moving average trading strategy provides you a powerful tool to follow trends and have signals for trading in Forex, stock market, Bitcoin or any other financial markets. Moving average trading strategy can be applied for intraday trading, scalping, swing trading, medium and long-term trading. Moving average crossover strategy in day trading is very common, and moving average crossover strategy in forex is very popular among traders. In this video moving average is completely explained, and it’s shown how moving average trading strategy is applied in forex and stock market. It is explained how number of periods is set for trading strategy, all on the charts showing you for example how the popular 50 and 200 moving average strategy in Forex is used for trading. Moving average can be considered as the most important indicator in technical analysis, because the moving average itself is an excellent tool for trading, and also it’s a foundation for many other indicators in technical analysis.

This video is a complete guide on moving averages, and if you are looking for a specific kind of moving average or any related points, you can can check the list below, I placed timestamps forwarding you directly to the ones you are interested to know.

TIMESTAMPS:

00:00 – Introduction

02:53 – Simple Moving Average

05:12 – Exponential Moving Average

06:48 – Simple Moving Average vs. Exponential Moving Average

08:13 – The Lag Factor (Number Of Periods In Moving Average)

09:11 – Common And Popular Number Of Periods For Moving Average

11:46 – Interpretation Of Moving Average

14:05 – Trend Identification

16:01 – Support And Resistance Identification

18:18 – Price Crossovers

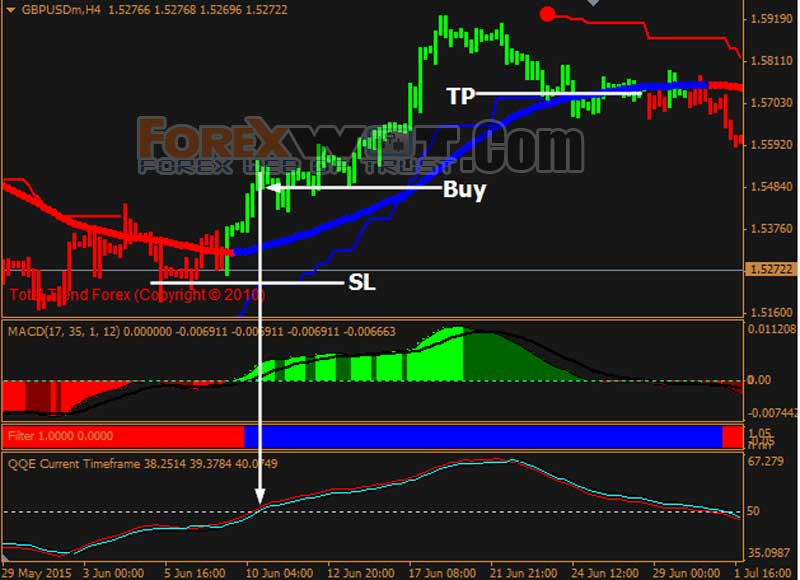

20:07 – Double Crossovers

21:19 – Triple Crossovers

22:10 – Double Exponential Moving Average

24:42 – Moving Average Ribbon

26:37 – Moving Average Envelopes

—————————————–

DISCLAIMER:

Please be advised that I am not a licensed financial advisor or registered investment advisor, and this material has been prepared for entertainment and informational purposes only, and it is not intended to be relied upon as investment, financial, accounting, tax, legal, regulatory or similar advice, and it is not an endorsement of any provider, product or service.

Trading and investing in financial markets poses considerable risk of loss, so please make sure to do your own research or consult a certified financial or investment advisor. The information and content provided on this channel does not guarantee any particular or expected outcome.

—————————————–

What Happens When 50 Sma Crosses 200 Sma, Complete Guide To Moving Average Trading Strategy.

How To End Up Being An Effective Forex Trader

Naturally, these moving averages are utilized as dynamic assistance and resistance levels. Elaborately designed techniques do not always work. Let’s start with a system that has a 50% opportunity of winning.

Complete Guide To Moving Average Trading Strategy, Watch popular complete videos relevant with What Happens When 50 Sma Crosses 200 Sma.

4 Concerns Your Trading Plan Ought To Answer

The objective of this brief term momentum trading strategy is to hit the earnings target as early as possible. A Forex trading strategy requires three main fundamental bands. The most effective indication is the ‘moving average’.

I just received an email from a member who states that they need aid with the technical analysis side of trading. The e-mail began me thinking about the easiest method to explain technical analysis to somebody who has no forex trading experience. So I desired to compose a short article explaining 2 popular indications and how they are utilized to generate income in the foreign exchange.

“Remember this Paul,” Peter Moving Average Trader stated as they studied the long term chart, “Wealth comes from taking a look at the big image. Lots of people believe that holding for the long term indicates permanently. I choose to hold things that are increasing in value.I take my cash and wait until the pattern turns up once again if the trend turns down.

Another excellent way to utilize the sideways market is to take scalping trades. Even though I’m not a big fan of scalping there are numerous traders who effectively make such trades. When rate approaches the resistance level and exit at the support level, you take a brief trade. Then you make a long trade at the assistance level and exit when rate approaches the resistance level.

Now when we utilize three MAs, the moving average with the least number of periods is characterized as quick while the other two are characterized as medium and sluggish. So, these three Forex MA Trading can be 5, 10 and 15. The 5 being quick, 10 medium and 15 the sluggish.

This suggests that you need to understand how to manage the trade prior to you take an entry. In a trade management method, you need to have written out precisely how you will control the trade after it is participated in the Stocks MA Trading so you understand what to do when things come up. Dominating trade management is extremely essential for success in trading. This part of the system must include information about how you will react to all sort of conditions one you go into the trade.

Let’s suppose you remain in the same camp as we are and you believe the long term outlook on gold is very favorable. So, each time it dips listed below a specific value level, you add more to your portfolio, basically “purchasing on the dips”. This might be rather different from somebody else who looked at a roll over as a reason to sell out. Yet, both traders are taking a look at the very same technical levels.

NEVER forecast and attempt ahead of time – act upon the truth of the modification in momentum and you will have the chances in your favour. Attempt and forecast and you are actually simply hoping and thinking and will lose.

Combining these 2 moving averages offers you a good structure for any trading plan. Chances are excellent that you will be able to make cash if you wait for the 10-day EMA to concur with the 200-day SMA. Just utilize great money management, do not risk excessive on each trade, and you ought to be fine.

The 2 most popular moving averages are the easy moving average and the exponential moving average. The declining ranges integrated with this week’s turnaround bar lead me to think that the next relocation is greater.

If you are looking instant entertaining comparisons related to What Happens When 50 Sma Crosses 200 Sma, and Most Advanced Live Trading Forex Robot Capable of Doubling Your Money, Moving Average Crossover you should subscribe for subscribers database for free.