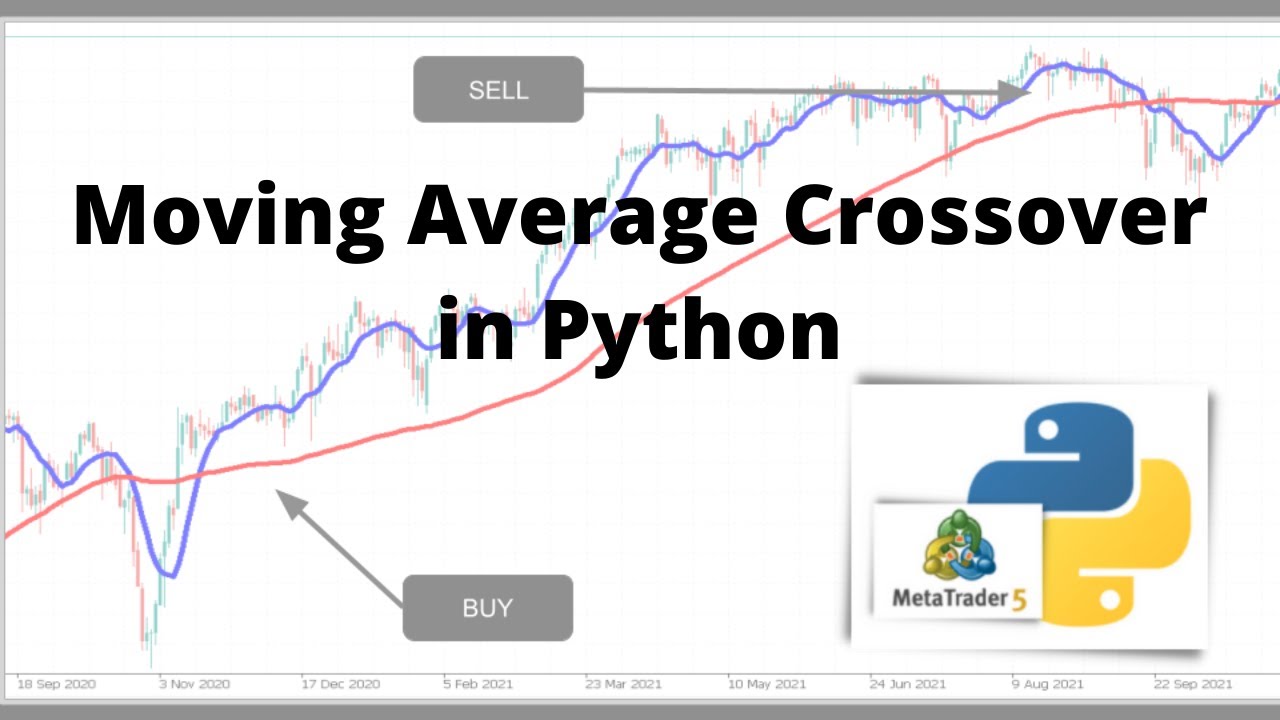

Code a Simple Moving Average (SMA) Crossover Trading Strategy in Python

Best clips top searched Technical Analysis Question, Currency Trading, Forex Investors, Buy and Sell the Cycles, and Ma Crossover EA, Code a Simple Moving Average (SMA) Crossover Trading Strategy in Python.

In this video, we will code and backtest the Simple Moving Average Crossover Strategy for Algorithmic Trading Chapters: 00:00 …

Ma Crossover EA, Code a Simple Moving Average (SMA) Crossover Trading Strategy in Python.

Helpful Ideas In Emini Trading

A method to determine the speed or significance of the move you are going to trade against. Rather of subscribing to an advisory letter you may choose to make up your own timing signal.

Code a Simple Moving Average (SMA) Crossover Trading Strategy in Python, Explore top complete videos about Ma Crossover EA.

Do You Trade Es Emini Market Noise Or The Trend

Let’s start with a system that has a 50% possibility of winning. Many traders lack the perseverance to watch their trade become an earnings after a few hours or more. For if the existing is real strong, you can make a fortune.

I simply got an email from a member who states that they require help with the technical analysis side of trading. The email started me believing about the most basic method to explain technical analysis to someone who has no forex trading experience. So I wanted to write an article describing 2 popular indications and how they are used to make money in the foreign exchange.

Every trade you open ought to be opened in the direction of the everyday trend. Despite the timeframe you utilize (as long as it is less than the day-to-day timeframe), you must trade with the overall direction of the marketplace. And the bright side is that finding the everyday trend Moving Average Trader is not difficult at all.

There are a couple of possible descriptions for this. The very first and most obvious is that I was merely setting the stops too close. This may have permitted the random “sound” of the price movements to trigger my stops. Another possibility is that either my broker’s dealing desk or some other heavy player in the market was taking part in “stop hunting”. I have actually written a more total article on this subject currently, but generally this includes market players who attempt to press the price to a point where they think a lot of stop loss orders will be activated. They do this so that they can either go into the market at a better cost on their own or to cause a snowballing relocation in an instructions that benefits their existing positions.

In the middle of this horrible experience, her 12 years of age daughter got home from School and discovered her mom in tears. “What’s incorrect Forex MA Trading?” her daughter asked. “Oh, this alternative trading will be the death of me beloved,” Sidney sobbed.

Now that you have actually determined the everyday pattern, fall to the lower timeframe and look at the Bollinger bands. You are looking for the Stocks MA Trading price to strike the extreme band that protests the daily trend.

The most used MA figures consist of the 20 Day MA, the 50 Day MA and the 200 Day MA. The 20 Day MA takes a look at the brief term average, the 50 Day looks that a more intermediate timespan and the 200 Day looks at a longer amount of time. The entire function for this technique is to just be invested when the security is over their moving average. It is ideal when it is over all three averages, however that typically isn’t the case. To keep threats down, I suggest just choosing the 200 Day Moving Average.

For these kind of traders brief term momentum trading is the finest forex trading strategy. The objective of this short term momentum trading strategy is to strike the earnings target as early as possible. This is achieved by getting in the market long or short when the momentum is on your side.

I know these suggestions might sound standard. and they are. But you would marvel the number of traders abandon a great trading system because they feel they need to have the ability to trade the system without any idea whatsoever. , if you would only learn to trade in the ideal direction and exit the trade with profits.. your look for a lucrative Forex system would be over.

My point is this – it does not actually matter which one you use. Long as the stock holds above that breakout level. Technical analysis can be extremely useful for traders to time our entries and exits of the trade.

If you are finding updated and engaging reviews relevant with Ma Crossover EA, and Trading Stocks, Successful Trader, Forex Education, How to Read Stock Charts dont forget to list your email address in email list totally free.