Breakout Watchlist! (3/29 – 4/1) | [AMRS, GOOGL, CRTO etc.]

Best full videos relevant with Forex Trading for Beginners – How to Use Moving Averages to Make Money, Biotech Stock, Bear Markets, and 50 Day Ema Trading Rules, Breakout Watchlist! (3/29 – 4/1) | [AMRS, GOOGL, CRTO etc.].

Learn anything valuable from the video? Make sure you subscribe to keep improving your trading!

Going over my watchlist for the upcoming trading week along with potential buy points. I’ll be breaking down all the technical indicators that led me to each of the stocks I cover that make them high probability breakout candidates.

Go vote on your favorite setup!

————————————————————————————————————–

ENDING SOON: Get 2 FREE STOCKS ON WEBULL when you deposit $100 (Valued up to $1850):

https://act.webull.com/k/oZ4Q9mX1DH4U/main

————————————————————————————————————–

For business inquires you can reach me at StockTricksWithNick@gmail.com

————————————————————————————————————–

Tik Tok Trading Challenge & Giveaway:

————————————————————————————————————–

* Follow me on Twitter for market news: https://mobile.twitter.com/StockTrickNick

* Follow me on Stocktwits as well: https://stocktwits.com/StockTricksWithNick

————————————————————————————————————–

Enjoy a free $10 with Public when you sign up using this link:

https://public.qwjcdi.net/c/2658372/985667/10608

————————————————————————————————————–

YouTube Contest Rules: https://support.google.com/youtube/answer/1620498?hl=en

Official Contest Rules:

https://docs.google.com/document/d/1iUz2UCAmzKJ35gfGezGZ5KRyhCM2LrbNrheIj4iud7M/edit?usp=sharing

Trading Workbook & Challenge Updates:

https://docs.google.com/spreadsheets/d/1QvwVSkfNkEfJKBPbfQwKwi5djnNM_8UFQeRcg361l48/edit?usp=sharing

————————————————————————————————————–

00:00 – Intro

01:42 – Breakout Watchlist

02:13 – Tik Tok Trading Challenge

03:03 – AEIS

04:23 – AMRS

05:37 – BW

06:24 – CARR

07:49 – CPE

09:23 – CTRO

10:23 – FDX

11:10 – GOOGL

12:16 – GPRE

13:15 – REKR

14:10 – SKY

15:29 – SNBR

16:18 – TGH

16:50 – TX

17:40 – VRTV

18:38 – SUBSCRIBE & LIKE!

#Watchlist #TradingStocks #StockMarket

50 Day Ema Trading Rules, Breakout Watchlist! (3/29 – 4/1) | [AMRS, GOOGL, CRTO etc.].

Forex Finance – The Secret To Triple Digit Gains

In a stock daily rate chart, if 50SMA moves up and crosses 200SMA, then the trend is up. You would have purchased in June 2003 and stuck with the up move until January 2008. A downtrend is indicated by lower highs and lower lows.

Breakout Watchlist! (3/29 – 4/1) | [AMRS, GOOGL, CRTO etc.], Watch most searched replays about 50 Day Ema Trading Rules.

10 Forex Trading Essentials

The goal of this short-term momentum trading technique is to hit the earnings target as early as possible. A Forex trading method needs three main standard bands. The most effective indication is the ‘moving average’.

Would not it be good if you were only in the stock exchange when it was going up and have whatever moved to money while it is decreasing? It is called ‘market timing’ and your broker or financial organizer will inform you “it can’t be done”. What that person just informed you is he does not know how to do it. He doesn’t understand his task.

3) Day trading means fast revenue, do not hold stock for more than 25 min. You can always sell with revenue if it begins to fall from top, and then buy it back later on if it Moving Average Trader end up going up again.

Technical Analysis uses historic rates and volume patterns to predict future behavior. From Wikipedia:”Technical analysis is often contrasted with essential Analysis, the research study of economic aspects that some experts state can affect rates in monetary markets. Technical analysis holds that costs already reflect all such influences before financiers understand them, hence the research study of rate action alone”. Technical Experts highly believe that by studying historic rates and other key variables you can forecast the future cost of a stock. Nothing is outright in the stock exchange, but increasing your probabilities that a stock will go the direction you anticipate it to based upon mindful technical analysis is more precise.

Assuming you did not see any news, you require to set a Forex MA Trading trade positioning design. For circumstances, if you see that the significant trend is headed up, look for buy signal created from FX indications, and do not even trade to cost this duration. This also applies when you see that the significant pattern is down, then you understand it is time to purchase.

Instead of signing up for an advisory letter you Stocks MA Trading choose to comprise your own timing signal. It will take some initial work, once done you will not need to pay anyone else for the service.

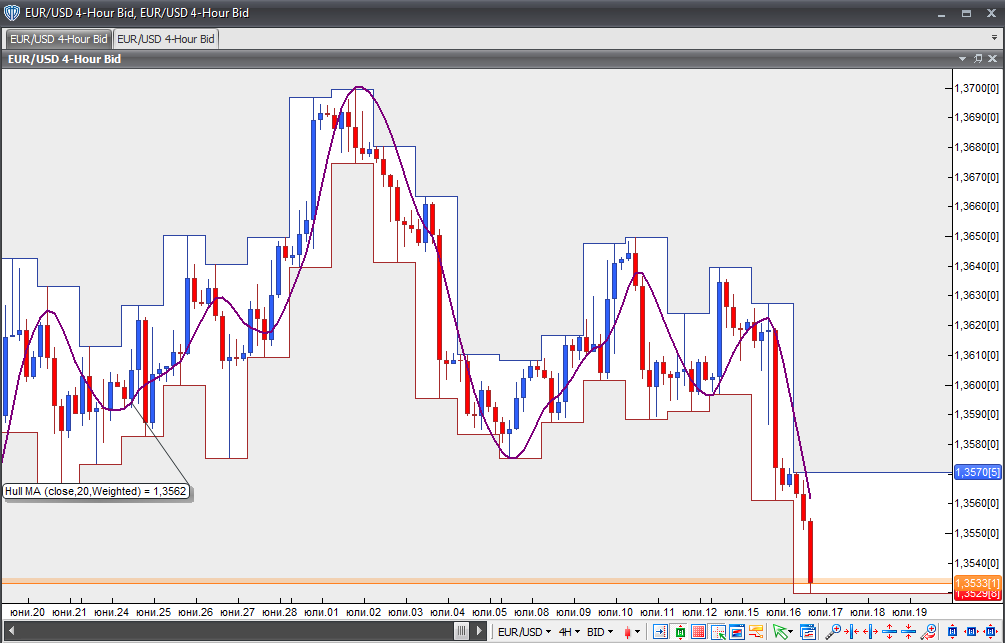

Here is a best example of a strategy that is basic, yet clever sufficient to assure you some included wealth. Start by selecting a particular trade that you think pays, say EUR/USD or GBP/USD. When done, choose 2 indications: weighted MA and simple MA. It is recommended that you use a 20 point weighted moving typical and a 30 point moving average on your 1 hour chart. The next action is to watch out for the signal to offer.

I have discussed this numerous times, but I believe it deserves discussing once again. The most typical moving average is the 200-day SMA (easy moving average). Really simply put, when the market is above the 200-day SMA, traders state that the market remains in an uptrend. The market is in a drop when rate is below the 200-day SMA.

There you have the 2 most vital lessons in Bollinger Bands. The HIG pattern I call riding the wave, and the CIT pattern I call fish lips. Riding the wave can usually be done longer approximately two months, utilizing stops along the method, one doesn’t even really require to enjoy it, of course one can as they ca-ching in one those safe revenues. The other pattern is fish lips, they are generally held for less than a month, and are left upon upper band touches, or mare precisely retreats from upper band touches. When the price touches the upper band and then retreats), (. Fish lips that re formed out of a flat pattern can often develop into ‘riding the wave,’ and after that are held longer.

What does the stock action need to appear like for your approach? Did you lose cash in 2008 stock exchange down turn? But even in that nonreligious bearishness, there were huge cyclical bull markets.

If you are finding instant engaging videos related to 50 Day Ema Trading Rules, and Commitment of Traders, Disciplined Trader, Stock Tips please subscribe in email subscription DB totally free.