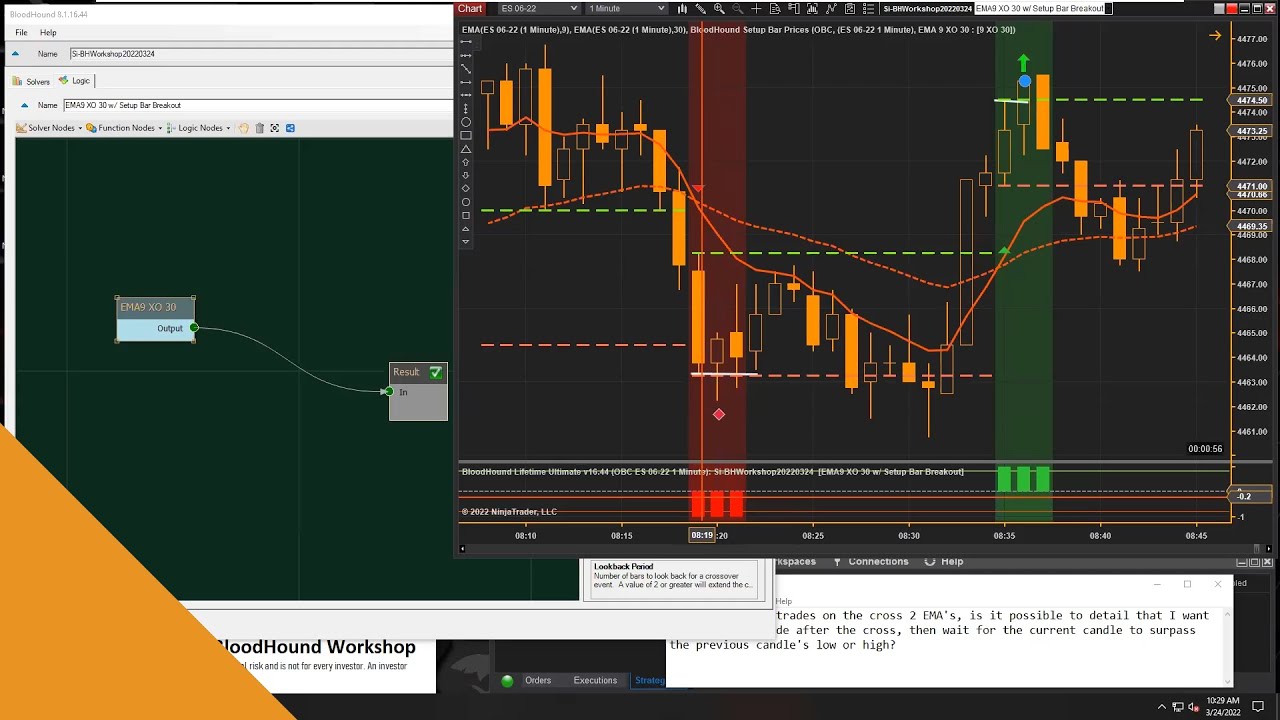

BloodHound – EMA Crossover Plus Next 3 Bars Must Close Above the Crossover Bar High

Popular full videos highly rated Online Forex Trading, Swing Trading, and What Is Ema Crossover, BloodHound – EMA Crossover Plus Next 3 Bars Must Close Above the Crossover Bar High.

This demonstrates a classic example of using the BloodHound Setup Bar Prices indicator. A long signal is produced if any of the next 3 bars closes above the high of a Setup bar. In this case, the Setup bar is the bar that prints when the EMA 9 crosses over the EMA 30. A short signal occurs on the opposite conditions.

BloodHound Template

#NinjaTrader

– – –

Futures, foreign currency and options trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing ones financial security or lifestyle. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results. View Full Risk Disclosure: https://www.sharkindicators.com/risk-disclosure/

What Is Ema Crossover, BloodHound – EMA Crossover Plus Next 3 Bars Must Close Above the Crossover Bar High.

Complimentary Day Trading System

Keep in mind that the previous indications can be used in mix and not only one. Even though I’m not a big fan of scalping there are numerous traders who successfully make such trades.

BloodHound – EMA Crossover Plus Next 3 Bars Must Close Above the Crossover Bar High, Get top high definition online streaming videos related to What Is Ema Crossover.

Scalping The Forex Market For Mega Profits

Throughout long-lasting nonreligious bear markets, a buy and hold method rarely works. A 50-day moving average line takes 10 weeks of closing price information, and then plots the average.

There are a terrific range of forex indicators based upon the moving average (MA). This is an evaluation on the easy moving average (SMA). The easy moving average is line produced by computing the average of a set variety of duration points.

The time frame is short and is from 2 minutes to 5 minutes. The shortest scalping method is tape reading where the Moving Average Trader checks out the charts and puts a trade for a brief time duration. In this post is the concentrate on longer trades than the short tape reading strategy.

Another great way to utilize the sideways market is to take scalping trades. Even though I’m not a huge fan of scalping there are numerous traders who effectively make such trades. When price approaches the resistance level and exit at the assistance level, you take a short trade. Then you make a long trade at the support level and exit when rate approaches the resistance level.

Market timing is based upon the “truth” that 80% of stocks will follow the instructions of the broad market. It is based on the “fact” that the Forex MA Trading trend gradually, have been doing so since the beginning of easily traded markets.

Taking the high, low, open and close values of the previous day’s rate action, tactical levels can be determined which Stocks MA Trading or might not have an impact on rate action. Pivot point trading puts emphasis on these levels, and uses them to assist entry and exit points for trades.

For each time a short article has actually been e-mailed, award it three points. An e-mailed short article means you have at least hit the interest nerve of some member of your target market. It may not have been a publisher so the category isn’t as valuable as the EzinePublisher link, but it is more important than an easy page view, which does not necessarily mean that somebody read the entire post.

It’s really real that the market pays a lot of attention to technical levels. We can show you chart after chart, breakout after breakout, bounce after bounce where the only thing that made the difference was a line drawn on a chart. Moving averages for example are best studies in when big blocks of money will purchase or offer. Enjoy the action surrounding a 200 day moving average and you will see first hand the warfare that occurs as shorts attempt and drive it under, and longs purchase for the bounce. It’s cool to enjoy.

A way to measure the velocity or significance of the move you are going to trade versus. This is the trickiest part of the formula. The most common way is to determine the slope of a MA against an otherwise longer term pattern.

Moving averages are just the average of previous prices. Now that I got that out of the way, its time for the method. The most typical method is to measure the slope of a MA against an otherwise longer term pattern.

If you are searching instant engaging comparisons about What Is Ema Crossover, and Chinese Markets, Stock Trading Course you are requested to list your email address for email subscription DB now.