Best moving average crossover for swing trading|exponential moving average|moving average strategy

Best full videos highly rated Trading Plan, Strong Trend, and Best Ma Crossover Settings, Best moving average crossover for swing trading|exponential moving average|moving average strategy.

best moving average crossover for swing trading|exponential moving average|moving average strategy

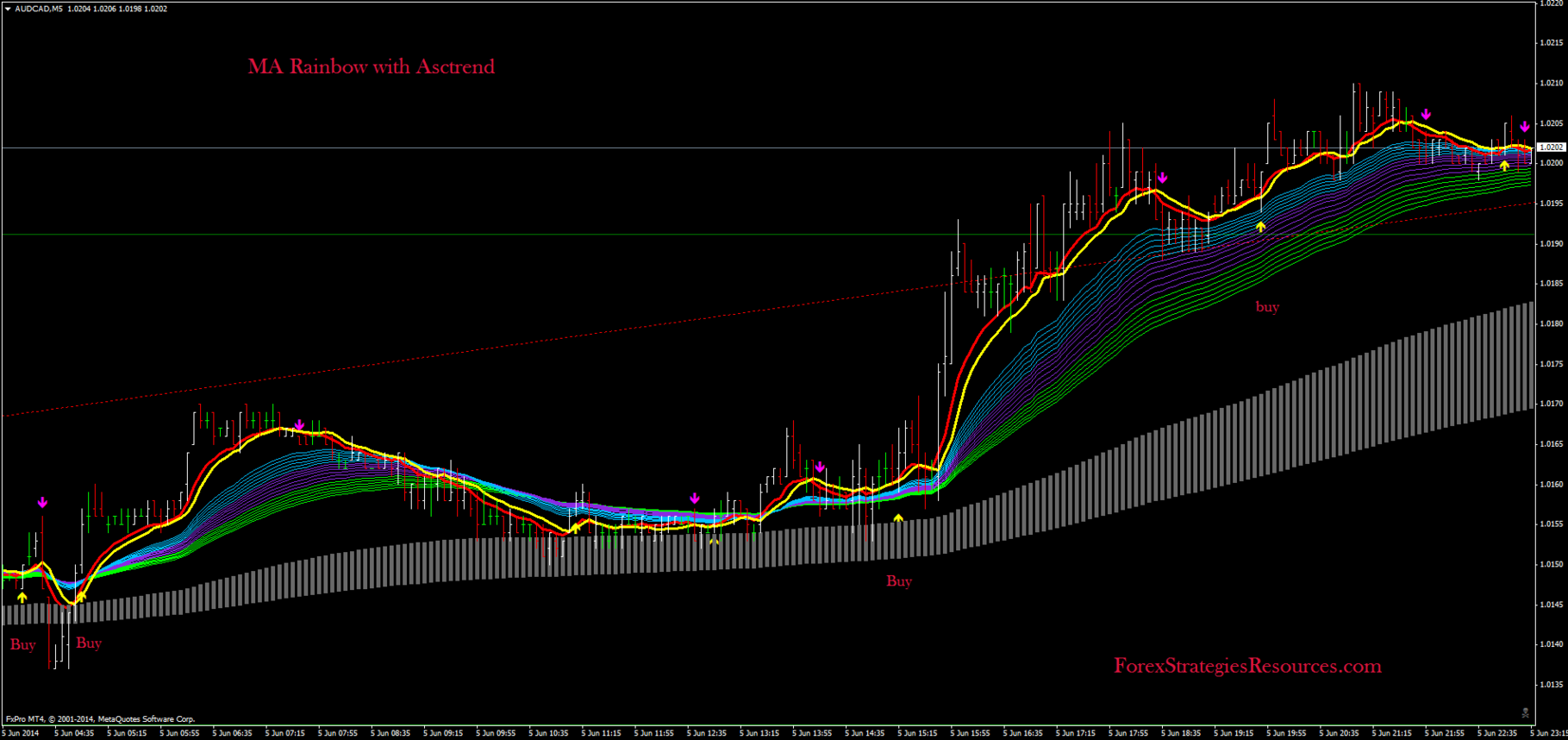

Crossovers are one of the main moving average strategies. The first type is a price crossover, which is when the price crosses above or below a moving average to signal a potential change in trend.

Another strategy is to apply two moving averages to a chart:

Welcome Friends to ‘s Biggest Technical Analysis Youtube Channel

Our Dream is to make you an Expert in Trading any Market, be it Indian Stocks, Commodity or Forex Trading. We plan to achieve that by:

* By providing you A-Z of Technical Analysis and Fundamental Analysis training,

* By Giving you tools, Strategies and Indicators to know the markets better,

* By Providing you a Demo trading platform free of cost to test the waters

* By Providing you a Mobile App, to Monitor, Study, Analyze and trade on the Go.

* By Providing you Free Honest Product reviews related to Trading.

Our Channel has Videos basic videos from what is Technical Analysis to advanced concepts like Trading Divergences, we have training videos in Trading Psychology, Money Management along with hardcore Technical Analysis videos.

Wishing you all the very best.

……………………………………………..

forex trading strategies

best forex trading platform

forex trading for beginners

forex trading tutorial

what is forex trading and how does it work

forex trading reviews

/////////////////////////////////////////

best moving average crossover trading strategy,best moving average crossover strategy,best moving average crossover,moving average crossover trading strategy,moving average crossover strategy,death cross,golden cross,david moadel,moving average crossover,moving average strategy,moving average trading strategy,moving average crossover backtest,moving averages tutorial,moving averages strategy,moving averages,moving average,EMA vs SMA,SMA vs EMA

Best Ma Crossover Settings, Best moving average crossover for swing trading|exponential moving average|moving average strategy.

Trend Following Forex – 3 Basic Actions To Capturing Huge Profits

The 5 EMA is the lead line, traders offer or purchase if it goes above or beneath the 13 line. In numerous instances we can, but ONLY if the volume boosts. Conquering trade management is really important for success in trading.

Best moving average crossover for swing trading|exponential moving average|moving average strategy, Search popular full length videos about Best Ma Crossover Settings.

Why Does The Stock Market Dislike Me – The Psychology Of Trading

Support and resistance are levels that the marketplace reaches before it reverses. You make 10% earnings and you sell up and get out. I prefer to hold things that are increasing in worth. Make sure you turn into one of that minority.

I just received an e-mail from a member who states that they need assist with the technical analysis side of trading. The email began me thinking about the most basic method to describe technical analysis to somebody who has no forex trading experience. So I wished to write an article describing 2 really popular signs and how they are utilized to earn money in the forex.

The down pattern in sugar futures is well founded due to the expectations of a substantial 2013 harvest that should be led by a record Brazilian harvest. This is news that everybody understands and this fundamental details has attracted excellent traders to the sell side of the marketplace. Technical traders have likewise had an easy go of it given that what rallies there have actually been have actually been capped perfectly by the 90 day moving average. In fact, the last time the 30-day Moving Average Trader average crossed under the 90-day moving average remained in August of in 2015. Lastly, technical traders on the brief side have actually gathered earnings due to the organized decline of the market therefore far rather than getting stopped out on any spikes in volatility.

The dictionary estimates an average as “the quotient of any sum divided by the number of its terms” so if you were exercising a 10 day moving average of the following 10, 20, 30, 40, 50, 60, 70, 80, 90, 100 you would include them together and divide them by 10, so the average would be 55.

You require to recognize the start of the break out that created the relocation you are going to trade against. Many individuals use Support and resistance lines to identify these locations. I discover them to be extremely Forex MA Trading efficient for this purpose.

This suggests that you require to know how to deal with the trade prior to you take an entry. In a trade management strategy, you ought to have written out exactly how you will manage the trade after it is gotten in into the Stocks MA Trading so you understand what to do when things come up. Dominating trade management is very essential for success in trading. This part of the system need to include details about how you will react to all sort of conditions one you enter the trade.

Another forex trader does care excessive about getting a roi and experiences a loss. This trader loses and his wins are on average, much bigger than losing. When he wins the game, he wins double what was lost. This shows a balancing in winning and losing and keeps the financial investments available to get a profit at a later time.

For example, 2 weeks ago JP Morgan Chase cut its projection for fourth quarter development to just 1.0%, from its currently decreased forecast of 2.5% just a couple of weeks previously. The company likewise slashed its forecast for the first quarter of next year to simply 0.5%. Goldman Sachs cut its projections greatly, to 1% for the 3rd quarter, and 1.5% for the 4th quarter.

Now, this extremely important if you alter the number of durations of the easy moving average, you need to change the standard variance of the bands as well. For example if you increase the period to 50, increase the standard discrepancy to 2 and a half and if you decrease the duration to 10, reduce the basic variance to one and a half. Periods less than 10 do not seem to work well. 20 or 21 duration is the optimum setting.

So, when the marketplace is varying, the finest trading technique is range trading. 3) Day trading indicates fast earnings, do not hold stock for more than 25 min. You ought to develop your own system of day trading.

If you are looking instant exciting reviews related to Best Ma Crossover Settings, and Trading Tip, Simple Moving Average, Forex Artificial Intelligence please subscribe our email alerts service now.