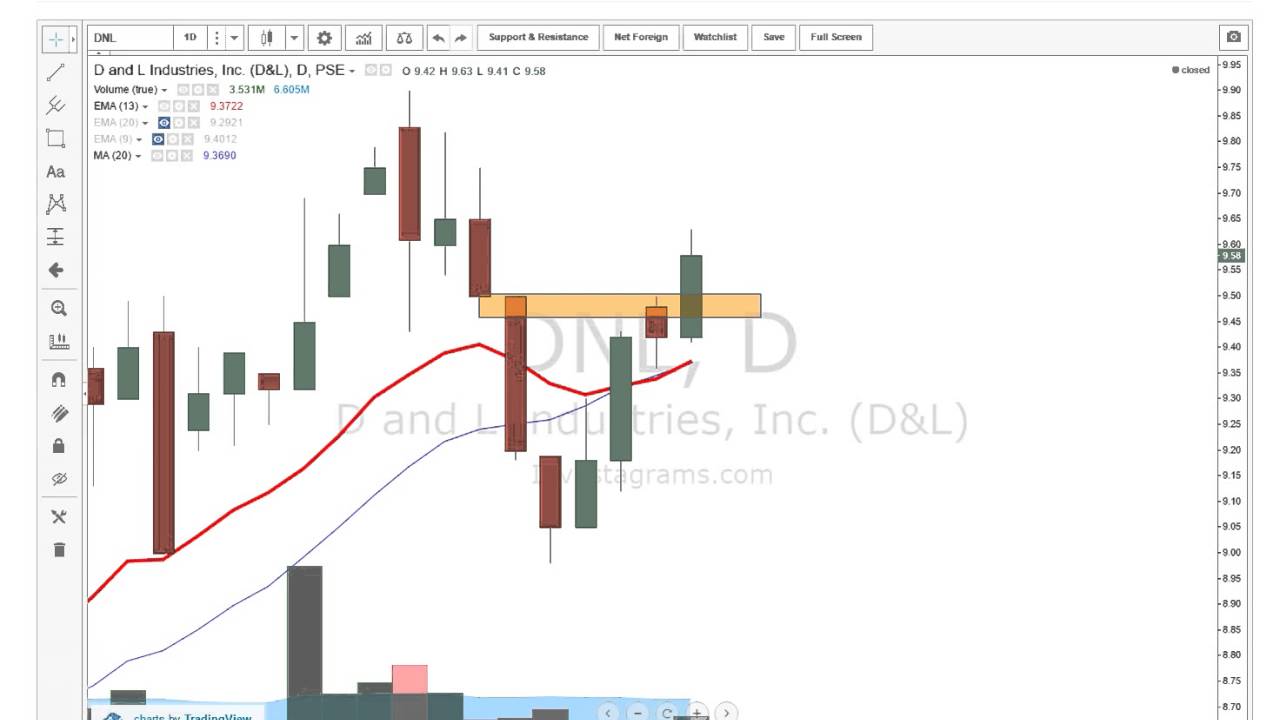

Automatic Analysis of EMA (13) x MA (20) Crossover using Investa Screener

Top replays about 200-Day Moving Average, Trading System Guide, Stock Sell Signals, How to Read Stock Charts, and What Is Ma 5 Crossover 10, Automatic Analysis of EMA (13) x MA (20) Crossover using Investa Screener.

In this video we discuss how the EMA 13 x MA 20 crossover system works, and how it can help us with trading. We also have included a new feature where you can ANTICIPATE the “cross” signal to be able to see these trades earlier.

You can now see which stocks pass through the EMA 13 x MA 20 strategy with just a few clicks using Investa Screener™

To gain access to Investa Screener just check the link for the steps: https://www.investagrams.com/Account/Tools/Application/Screener

———————

FOR ANDROID USERS: You can download the Investagrams app here:

https://play.google.com/store/apps/details?id=com.investagrams.investagrams

FOR IOS: we are doing our best working on it, we’re gonna launch it soon.

What Is Ma 5 Crossover 10, Automatic Analysis of EMA (13) x MA (20) Crossover using Investa Screener.

The Most Typical Forex Mistakes – Part 1

There’s plenty out there, but we only recommend one. Another example of a basic timing system may be expressed as follows. Volume is one of the most crucial signs to try to find.

Since they are lagging indications.

Automatic Analysis of EMA (13) x MA (20) Crossover using Investa Screener, Search top full videos about What Is Ma 5 Crossover 10.

6 Trading Routines To Make Every Effort For

What were these essential experts missing out on? Once a trend remains in motion, we like to route stops behind the 40 day ma. An uptrend is shown by higher highs and greater lows. Since they are lagging signs.

Would not it be great if you were just in the stock market when it was increasing and have everything moved to cash while it is decreasing? It is called ‘market timing’ and your broker or monetary organizer will tell you “it can’t be done”. What that individual simply told you is he does not understand how to do it. He doesn’t understand his job.

Every trade you open should be opened in the direction of the day-to-day trend. Regardless of the timeframe you use (as long as it is less than the daily timeframe), you ought to trade with the overall instructions of the marketplace. And fortunately is that discovering the everyday pattern Moving Average Trader is not tough at all.

This is an extremely excellent concern. The answer is quite interesting though. It is merely since everyone is utilizing it, specifically those huge banks and organizations. They all utilize it that way, so it works that method. In fact, there are mathematic and statistic theories behind it. Welcome to do more research on this one if you are interested in it. This short article is for regular readers. So I don’t desire to get unfathomable into this.

Assuming you did not see any news, you require to set a Forex MA Trading trade positioning design. For instance, if you see that the major trend is directed, search for buy signal created from FX indicators, and do not even trade to cost this duration. This also applies when you see that the major pattern is down, then you know it is time to buy.

Follow your trading character. What are your requirements? What are your objectives? Do the research, discover the Stocks MA Trading styles that fit your requirements, figure out which indications work for you etc.

As bad as things can feel in the rare-earth elements markets these days, the truth that they can’t get too much worse needs to console some. Gold particularly and silver are looking great technically with gold bouncing around strong assistance after its second perform at the age-old $1,000. Palladium looks to be holding while platinum is anybody’s guess at this point.

Shorting isn’t for everyone, but here is among my techniques for selecting stocks to brief. Weak point is a stock trading listed below the 200 day moving average – make a list of all stocks that are trading below that level.

Don’t just purchase and hold shares, at the exact same time active trading is not for everyone. Use the 420 day SMA as a line to choose when to be in or out of the S&P 500. When the market falls below the 420 day SMA, traders can likewise look to trade short.

Well, if an effective move is underway, then the price is moving far from the average, and the bands broaden. But this does not mean you ought to go into every trade signals that turns up.

If you are searching most exciting reviews about What Is Ma 5 Crossover 10, and Bear Markets, Global Market Divergences, Forex Strategy, Penny Stock you should subscribe our a valuable complementary news alert service totally free.