Adding One Indicator to Another Indicator in MT4

Best YouTube videos highly rated Best Forex Technical Analysis, Forex Education, and Ma Crossover mt4, Adding One Indicator to Another Indicator in MT4.

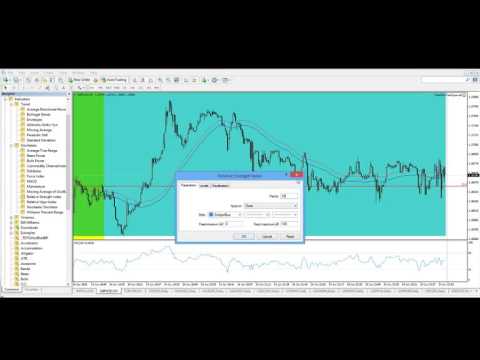

Here is how to add one indicator to another in MT4. For example, if you have an RSI on your MetaTrader4 chart, and you want to add a moving average to the RSI, this video shows you how to do that.

The main steps are to:

-Add an indicator to your chart.

-Open your navigator window (or insert another indicator) and drag the indicator you want to add to the first indicator onto your chart. –A properties will pop up. Click the Parameters tab.

-From the Apply To dropdown menu, select “First Indicator’s Data” and that will apply the second indicator to the one already on your chart.

Ma Crossover mt4, Adding One Indicator to Another Indicator in MT4.

5 Easy Actions – Stock Trading System

Chart: A chart is a chart of price over an amount of time. Now, this thesis is to assist private traders with criteria that have shown to be rather reliable. A period of 5 along with 13 EMA is generally used.

Adding One Indicator to Another Indicator in MT4, Find popular replays relevant with Ma Crossover mt4.

Genuine Time Forex Charts – The Friendly Tool Needed By Traders To Succeed

Rather, you ought to focus on four to 5 indications to make a trading decision. In a varying market, heavy losses will happen. There are many techniques and indicators to identify the trend.

If you have actually been in currency trading for any length of time you have actually heard the following two phrases, “trend trade” and “counter pattern trade.” These 2 methods of trading have the very same credibility and need just as much work to master. Because I have found a system that enables me to find high frequency trades, I like trading counter pattern.

A common forex price chart can look extremely irregular and forex candlesticks can obscure the pattern further. The Moving Average Trader typical offers a smoothed chart that is plotted on top of the forex chart, along with the japanese candlesticks.

Another great way to utilize the sideways market is to take scalping trades. Despite the fact that I’m not a big fan of scalping there are many traders who effectively make such trades. You take a short trade when rate approaches the resistance level and exit at the support level. Then you make a long trade at the support level and exit when rate approaches the resistance level.

To make this easier to understand, let’s put some numbers to it. These are streamlined examples to illustrate the concept and the numbers Forex MA Trading or may not match real FX trading methods.

Throughout these times, the Stocks MA Trading consistently breaks support and resistance. Of course, after the break, the prices will typically pullback before advancing its method.

If you utilize info offered by FXCM, you will be able to see the trend amongst traders of forex. Day-to-day revenue and loss changes show there is a big loss and this means traders do not end and benefit up losing cash instead. The gain daily was only 130 pips and the highest loss was a drop of over 170 points.

It’s really true that the market pays a lot of attention to technical levels. We can show you chart after chart, breakout after breakout, bounce after bounce where the only thing that made the distinction was a line made use of a chart. Moving averages for example are ideal research studies in when big blocks of money will purchase or offer. See the action surrounding a 200 day moving average and you will see first hand the warfare that happens as shorts try and drive it under, and longs buy for the bounce. It’s cool to see.

To assist you identify trends you should likewise study ‘moving averages’ and ‘swing trading’. For instance 2 basic guidelines are ‘don’t purchase a stock that is listed below its 200-day moving typical’ and ‘do not buy a stock if its 5-day moving average is pointing down’. If you do not understand what these quotes suggest then you need to research ‘moving averages’. Great luck with your trading.

Those are the moving averages of that specific security. With each new day it drops the first cost utilized in the previous day’s computation. Others are more aggressive and switch in between short and long frequently.

If you are searching unique and engaging comparisons about Ma Crossover mt4, and Momentum Forex Trading Strategy, FX Trading System, Stock Investing, Exploration Stocks you are requested to signup our email list totally free.