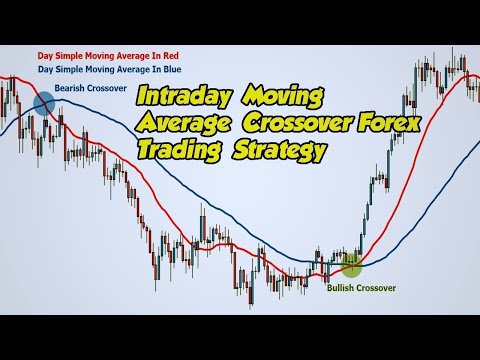

99% accurate moving average crossover for intraday trading Strategies|best moving average crossover

Best replays highly rated Best Moving Averages, Best Forex Technical Analysis, Best Forex, and Ma Crossover Expert, 99% accurate moving average crossover for intraday trading Strategies|best moving average crossover.

99% accurate moving average crossover for intraday trading Strategies|best moving average crossover

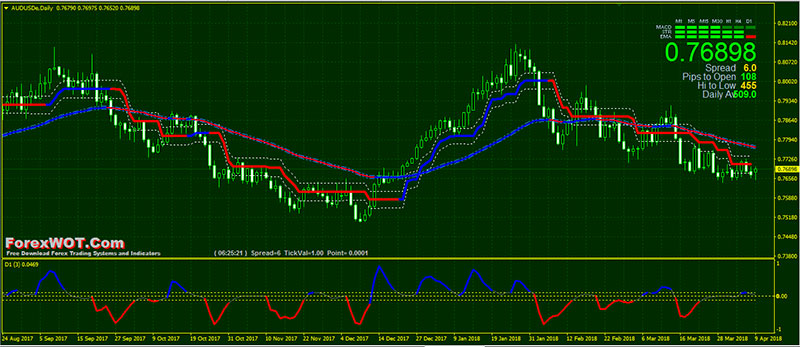

A forex trader can create a simple trading strategy to take advantage of trading opportunities using just a few moving averages (MAs) or associated indicators. MAs are used primarily as trend indicators and also identify support and resistance levels. The two most common MAs are the simple moving average (SMA), which is the average price over a given number of time periods, and the exponential moving average (EMA), which gives more weight to recent prices. Both of these build the basic structure of the Forex trading strategies below.

95% Profitable Moving Average Crossovers Forex Trading Strategies|Intraday Forex Trading Strategy

Forex Breakout Strategy Rules: How to be Successfull Traders Forex for beginners

How To Trade Trendline Breakout forex Trading Strategy|With The Complete Guide to Breakout Trading

How To Use The Bulls Power And Bears Power Indicators|Simple Forex Trading Strategies

100% Winning Profitable Bollinger Band Best Forex Trading Strategies

best moving average strategy for scalping

best moving average strategy forex

best moving average strategy for intraday trading

best moving average strategy for swing trading

best moving average strategy for binary options

best moving average strategy for bitcoin

best moving average strategy for 15 min chart

best moving average strategy for 1 hour chart

best moving average strategy crypto

best hull moving average strategy

best short term moving average strategy

3 moving average crossover strategy

best moving average setting for h1

best moving average for 5 min chart

best moving average settings for day trading

moving average strategy pdf

best moving average for 15 min chart

best moving average crossover for swing trading

best moving average crossover for intraday trading

best exponential moving average strategy

Ma Crossover Expert, 99% accurate moving average crossover for intraday trading Strategies|best moving average crossover.

Break Without Old Trading Ideas

A breakout with not much volume does not tell us much. A ‘moving’ average (MA) is the typical closing cost of a certain stock (or index) over the last ‘X’ days. Support-this term describes the bottom of a stock’s trading range.

99% accurate moving average crossover for intraday trading Strategies|best moving average crossover, Play interesting full length videos relevant with Ma Crossover Expert.

Applying Poker Strategies To Trading The Markets

I discover that the BI often exposes the predisposition of a stock for the day. Your speed of paddling can be assisted by the speed of the present. You wish to make cash in the forex, right?

New traders typically ask the number of indications do you recommend using at one time? You do not need to fall victim to analysis paralysis. You must master just these two oscillators the Stochastics and the MACD (Moving Average Merging Divergence).

“Remember this Paul,” Peter Moving Average Trader said as they studied the long term chart, “Wealth comes from looking at the big photo. Many individuals think that holding for the long term means permanently. I prefer to hold things that are increasing in worth.If the trend refuses, I take my cash and wait up until the pattern shows up once again.

Technical Analysis utilizes historic costs and volume patterns to anticipate future habits. From Wikipedia:”Technical analysis is regularly contrasted with fundamental Analysis, the research study of financial elements that some analysts state can influence prices in monetary markets. Technical analysis holds that costs already reflect all such influences prior to financiers understand them, for this reason the research study of cost action alone”. Technical Analysts highly think that by studying historic costs and other essential variables you can forecast the future price of a stock. Absolutely nothing is absolute in the stock market, however increasing your likelihoods that a stock will go the direction you expect it to based on mindful technical analysis is more precise.

Market timing is based upon the “reality” that 80% of stocks will follow the instructions of the broad market. It is based upon the “truth” that the Forex MA Trading pattern over time, have been doing so considering that the start of freely traded markets.

One of the main signs that can assist you develop the method the index is moving is the Moving Typical (MA). This takes the index price over the last given number of averages and days it. With each brand-new day it drops the first price utilized in the previous day’s calculation. If you are looking to day trade or invest, it’s constantly great to check the MA of a number of periods depending. If you’re aiming to day trade then a MA over 5, 15, and thirty minutes are a great concept. Then 50, 100, and 200 days might be more what you require, if you’re looking for long term investment. For those who have trades lasting a couple of days to a few weeks then periods of 10, 20 and 50 days Stocks MA Trading be more appropriate.

For each time an article has actually been e-mailed, award it three points. An e-mailed post suggests you have at least hit the interest nerve of some member of your target market. It may not have actually been a publisher so the classification isn’t as important as the EzinePublisher link, however it is better than an easy page view, which doesn’t necessarily imply that somebody read the entire short article.

NEVER anticipate and try beforehand – act upon the reality of the change in momentum and you will have the odds in your favour. Try and predict and you are really just guessing and hoping and will lose.

18 bar moving average takes the present session on open high low close and compares that to the open high low close of 18 days ago, then smooths the typical and puts it into a line on the chart to give us a pattern of the current market conditions. Breaks above it are bullish and breaks below it are bearish.

It is invariably used in double format, e.g. a 5 day moving average and a 75 day moving average. In many instances we can, but ONLY if the volume boosts. A sag is suggested by lower highs and lower lows.

If you are finding updated and engaging reviews related to Ma Crossover Expert, and Trading Forex With Indicators, When to Buy Stocks, Trading Stocks you should list your email address for email subscription DB for free.