30 Most POPULAR Fortnite CROSSOVER Skins

Latest high defination online streaming related to Forex Trading Strategies, Trading Info, and What Is Ma 5 Crossover 10, 30 Most POPULAR Fortnite CROSSOVER Skins.

30 Most LOVED Fortnite CROSSOVER Skins!

Item Shop Code: T5G #UseCodeT5G #Fortnite

T5G Discord: https://discord.gg/T5G (Join to be apart of the community)

Follow us on Instagram & Twitter to be informed when we post:

Tweets by Top5Gamingx

https://www.instagram.com/top5gamingx/

Check out our Other Videos Here

15 SECRET Fortnite MYTHS Busted!

30 FUTURE Fortnite Updates FINALLY REVEALED!

15 SECRET Fortnite MYTHS Busted!

Fortnite’s LEAKED Updates REVEAL THE FUTURE!

Notice: We earn revenue from you supporting us in the Fortnite Item Shop. Thank you to Epic Games for partnering with us.

What Is Ma 5 Crossover 10, 30 Most POPULAR Fortnite CROSSOVER Skins.

Forex Day Trading System

Nevertheless it has the advantage of providing, in many situations, the least expensive entry point.

Now if you take a look at a moving average, you see it has no spikes, as it smooths them out due to its averaging.

30 Most POPULAR Fortnite CROSSOVER Skins, Enjoy new updated videos about What Is Ma 5 Crossover 10.

Bollinger Band Trading

Rapid MAs weigh more current costs heavier. A 50-day moving typical line takes 10 weeks of closing price data, and after that plots the average. This trader loses and his wins are on average, much larger than losing.

In my earlier short articles, we have actually found out indicators, chart patterns, money management and other pieces of effective trading. In this short article, let us examine those pieces and puzzle them together in order to find conditions we prefer for getting in a trade.

When a stock relocations in between the assistance level and the resistance level it is said to be in a pattern and you need to buy it when it reaches the bottom of the Moving Average Trader pattern and sell it when it arrives. Normally you will be searching for a short-term profit of around 8-10%. You make 10% revenue and you offer up and get out. You then look for another stock in a comparable pattern or you wait on your original stock to fall back to its support level and you buy it back once again.

The fact that the BI is evaluating such an useful period suggests that it can often identify the bias for the day as being bullish, bearish, or neutral. The BI represents how the bulls and bears develop their preliminary positions for the day. A relocation far from the BI indicates that one side is more powerful than the other. A stock moving above the BI implies the prevailing belief in the stock is bullish. The manner in which the stock breaks above and trades above the BI will suggest the strength of the bullish belief. When a stock moves below its BI, the very same however opposite analysis uses.

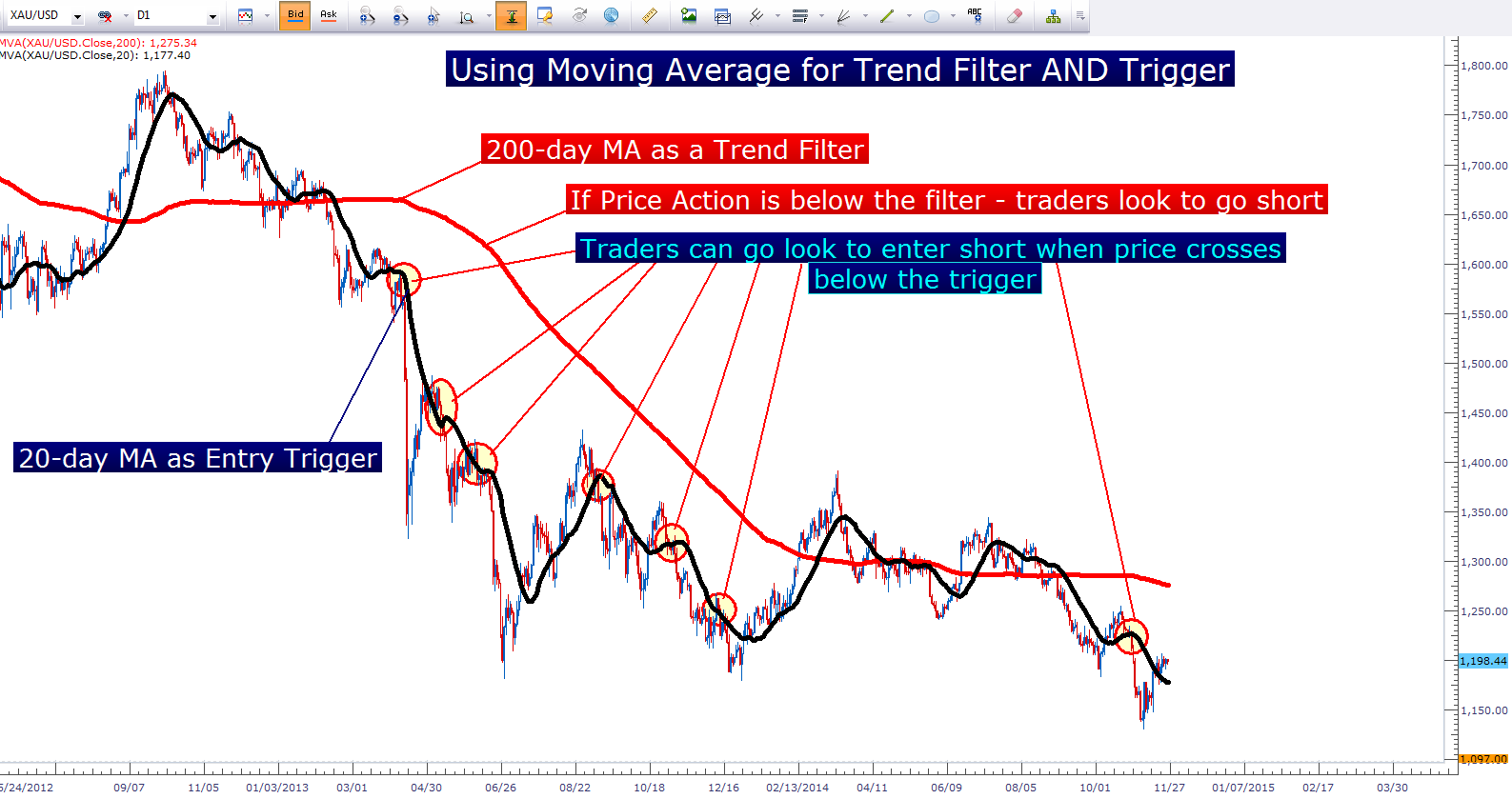

What does that Forex MA Trading tell you about the instructions it is heading? Is it in an upward or a downward trend? Charts of the primary index can inform you this by a fast glimpse. If the line is heading downward then it’s in a down trend, but with the disorderly nature of the index rate, how do you know if today’s down is not simply a glitch and tomorrow it will go back up once again?

Rather of registering for an advisory letter you Stocks MA Trading decide to make up your own timing signal. It will take some initial work, however as soon as done you will not need to pay anyone else for the service.

At its core your FOREX trading system requires to be able to find patterns early and likewise be able to prevent sharp increases or falls due to a particularly volatile market. At first glance this might appear like a hard thing to achieve and to be honest no FOREX trading system will perform both functions flawlessly 100% of the time. However, what we can do is design a trading system that works for the huge majority of the time – this is what we’ll concentrate on when creating our own FOREX trading system.

Stochastics sign has got two lines referred to as %K and %D. Both these lines are outlined on the horizontal axis for a given period. The vertical axis is plotted on a scale from 0% to 100%.

18 bar moving typical takes the current session on open high low close and compares that to the open high low close of 18 days back, then smooths the average and puts it into a line on the chart to offer us a pattern of the current market conditions. Breaks above it are bullish and breaks below it are bearish.

But as soon as the 9 day crosses over the 4 day it is a sell signal. To help you identify patterns you need to also study ‘moving averages’ and ‘swing trading’. At least as far as the retail financier is concerned.

If you are looking best ever engaging videos relevant with What Is Ma 5 Crossover 10, and What Are the Best Indicators to Use, Demarker Indicator you are requested to subscribe in subscribers database totally free.