3 BEST 200 EMA Moving Average Trading Strategies That Can Help You Become Profitable

Trending guide relevant with Simple Moving Average, Learn How to Trade, Forex Trading Indicators, Forex Trading for Beginners – How to Properly Use 2 Simple Moving Averages to Find Good Trades, and Best Ema Trading Strategy, 3 BEST 200 EMA Moving Average Trading Strategies That Can Help You Become Profitable.

✅ Join Stay Ahead’s Master Trading Program at 499 – https://imjo.in/AYV95t

3 Best 200 period moving average trading strategies is one of the most sought after topic in share market because moving averages are one of the most used indicator in stock market technical analysis but only a few traders knows to use moving averages professionally.

Topics covered in this video:

why 200 EMA is strongest moving average amongst all

what are 3 best 200 EMA trading strategies?

How to trade strategy no. 1 – Using 200 EMA for trend continuation

How to trade strategy no. 2 – using 200 EMA as Support & Resistance

How to trade strategy no. 2 – Using 200 EMA for trend reversal

========================

✅ Contact me:

Email: omen14th@gmail.com

Whatsapp No.: 6352353252

========================

✅ Follow me on social media (links): https://linktr.ee/stayaheadofficial

Best Ema Trading Strategy, 3 BEST 200 EMA Moving Average Trading Strategies That Can Help You Become Profitable.

Prevent Forex Gaming – Proper Cash Management

My point is this – it does not actually matter which one you use. Assuming you did not see any news, you need to set a forex trade putting style. This is to anticipate the future trend of the price.

3 BEST 200 EMA Moving Average Trading Strategies That Can Help You Become Profitable, Enjoy new reviews related to Best Ema Trading Strategy.

Your Forex Trading System – How To Select One That Isn’t Going To Drive You Nuts

3) Day trading indicates quick earnings, do not hold stock for more than 25 minutes. They do not understand proper trading techniques. This suggests that you require to know how to manage the trade before you take an entry.

New traders typically ask the number of signs do you recommend utilizing at one time? You do not require to succumb to analysis paralysis. You ought to master just these two oscillators the Stochastics and the MACD (Moving Average Convergence Divergence).

Nevertheless, if there is a breakout through among the outer bands, the rate will tend to continue in the exact same instructions for a while and robustly so if there is a boost Moving Average Trader in volume.

This is a great question. The answer is quite intriguing though. It is merely because everyone is using it, particularly those big banks and institutions. They all utilize it that method, so it works that way. Really, there are mathematic and fact theories behind it. If you have an interest in it, welcome to do more research on this one. This article is for routine readers. So I don’t wish to get too deep into this.

The dictionary prices quote a typical as “the Forex MA Trading quotient of any sum divided by the variety of its terms” so if you were working out a 10 day moving average of the following 10, 20, 30, 40, 50, 60, 70, 80, 90, 100 you would add them together and divide them by 10, so the average would be 55.

Throughout these times, the Stocks MA Trading regularly breaks support and resistance. Obviously, after the break, the prices will generally pullback before advancing its method.

In addition, if the 5 day moving average is pointing down then stay away, consider an additional product, one where by the 5-day moving average is moving north. And do not buy a trade stock when it truly is down listed below its two-hundred day moving average.

This is where the typical closing points of your trade are calculated on a rolling bases. State you wish to trade a per hour basis and you wish to plot an 8 point chart. Simply collect the last 8 per hour closing points and divide by 8. now to making it a moving average you move back one point and take the 8 from their. Do this 3 times or more to establish a pattern.

In this post is detailed how to sell a fashionable and fading market. This article has only detailed one method for each market scenario. It is suggested traders use more than one method when they trade Forex online.

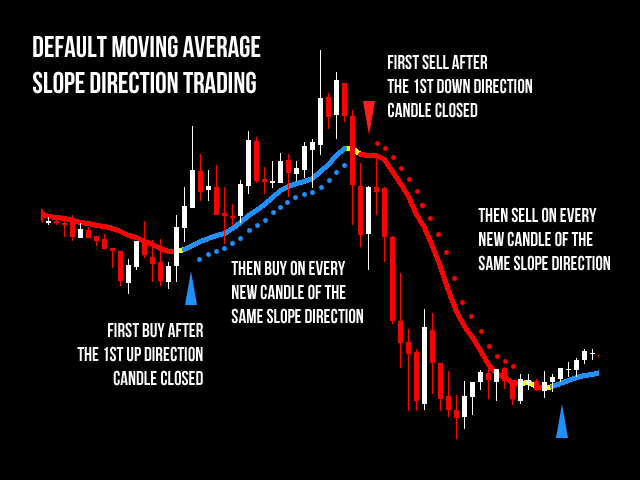

Moving averages are simply the average of previous costs. Now that I got that out of the method, its time for the technique. The most typical way is to determine the slope of a MA against an otherwise longer term trend.

If you are finding more entertaining comparisons related to Best Ema Trading Strategy, and Forex Training, Currency Trading, Stock Investing, Currency Exchange Rate you should list your email address in email alerts service for free.