2021 | PAID MOVING AVERAGE CROSSOVER STRATEGY|MADE PUBLIC|LEAKED

Top reviews related to Market Tops, Market Trend, and What Is Ma 5 Crossover 10, 2021 | PAID MOVING AVERAGE CROSSOVER STRATEGY|MADE PUBLIC|LEAKED.

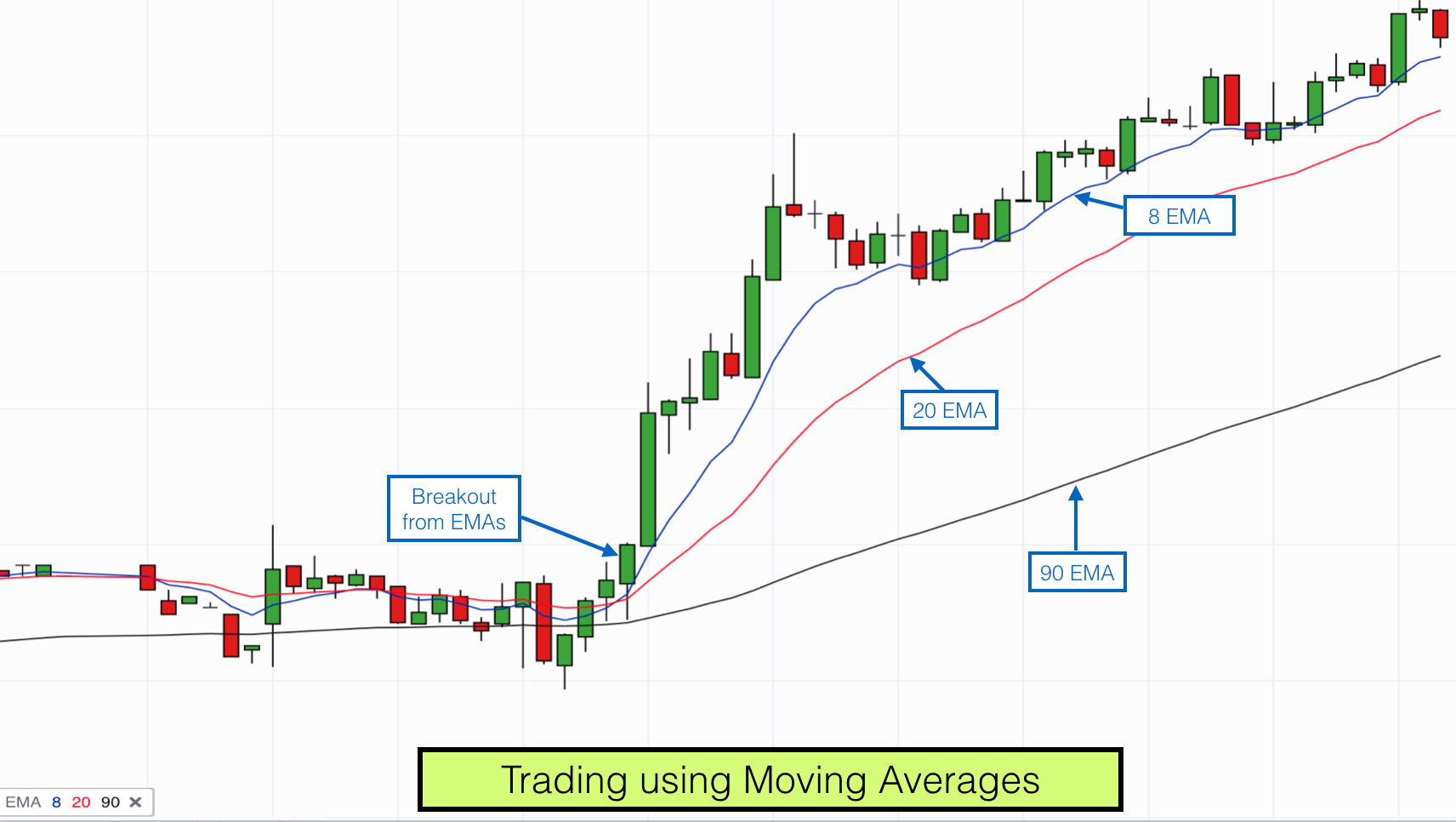

Many people makes use of moving averages but I bet you this particular strategy is just too different in moving average strategies that you have been seeing because this particular strategy is going to enlighten you and teach you and also help you to understand where to enter a trade and were not to enter a trade follow this strategy and learn a whole lot about moving averages in which nobody have ever thought you in your lifetime,please subscribe to the Channel and support me by liking and commenting tell me what you feel in the comment box

What Is Ma 5 Crossover 10, 2021 | PAID MOVING AVERAGE CROSSOVER STRATEGY|MADE PUBLIC|LEAKED.

4 Concerns Your Trading Plan Need To Answer

Nasdaq has actually rallied 310 points in 3 months, and struck a new four-year high at 2,201 Fri early morning.

Lots of indicators are readily available in order to determine the patterns of the marketplace.

2021 | PAID MOVING AVERAGE CROSSOVER STRATEGY|MADE PUBLIC|LEAKED, Watch trending full videos about What Is Ma 5 Crossover 10.

Forex Money Management – Handle Volatility Or Lose Your Equity

The greatest signal is where the existing rate goes through both the SMAs at a steep angle. On April 28, the gold-silver ratio had to do with 30, fairly low. I have been trading futures, alternatives and equities for around 23 years.

In less than 4 years, the rate of oil has actually increased about 300%, or over $50 a barrel. The Light Crude Constant Contract (of oil futures) hit an all-time high at $67.80 a barrel Friday, and closed the week at $67.40 a barrel. Persistently high oil costs will eventually slow financial development, which in turn will trigger oil costs to fall, ceritus paribus.

The downward trend in sugar futures is well founded due to the expectations of a substantial 2013 harvest that must be led by a record Brazilian harvest. This is news that everyone understands and this essential info has actually attracted good traders to the sell side of the marketplace. Technical traders have also had an easy go of it because what rallies there have been have actually been capped perfectly by the 90 day moving average. In truth, the last time the 30-day Moving Average Trader typical crossed under the 90-day moving average remained in August of in 2015. Lastly, technical traders on the brief side have actually gathered revenues due to the organized decrease of the market therefore far instead of getting stopped out on any spikes in volatility.

The most standard application of the BI concept is that when a stock is trading above its Bias Indicator you need to have a bullish predisposition, and when it is trading below its Bias Indication you must have a bearish predisposition.

Now when we utilize three MAs, the moving average with the least variety of durations is characterized as quick while the other two are characterized as medium and sluggish. So, these three Forex MA Trading can be 5, 10 and 15. The 5 being quick, 10 medium and 15 the slow.

Now that you have actually determined the day-to-day pattern, fall to the lower timeframe and look at the Bollinger bands. You are looking for the Stocks MA Trading rate to strike the extreme band that is against the day-to-day pattern.

If you utilize details provided by FXCM, you will be able to see the pattern amongst traders of forex. Daily earnings and loss modifications show there is a big loss and this suggests traders do not end and benefit up losing cash rather. The gain daily was only 130 pips and the greatest loss was a drop of over 170 points.

Using the moving averages in your forex trading business would show to be very advantageous. First, it is so simple to utilize. It exists in a chart where all you have to do is to keep a keen eye on the finest entrance and exit points. If the MAs are increasing, thats an indication for you to start purchasing. However, if it is going down at a constant speed, then you must begin offering. Having the ability to check out the MAs right would definitely let you recognize where and how you are going to make more money.

I understand these tips might sound basic. and they are. But you would marvel the number of traders abandon an excellent trading system because they feel they should have the ability to trade the system without any idea whatsoever. , if you would only find out to trade in the right direction and exit the trade with earnings.. your look for a profitable Forex system would be over.

3) Day trading suggests quick earnings, do not hold stock for more than 25 min. They may get the greatest benefits however they take the most risks and are more bettor than financier. You may also start to move money into bear ETFs.

If you are finding updated and exciting reviews related to What Is Ma 5 Crossover 10, and Forex Day Trading, Buy Weakness, Online Forex Trading dont forget to list your email address our email list for free.