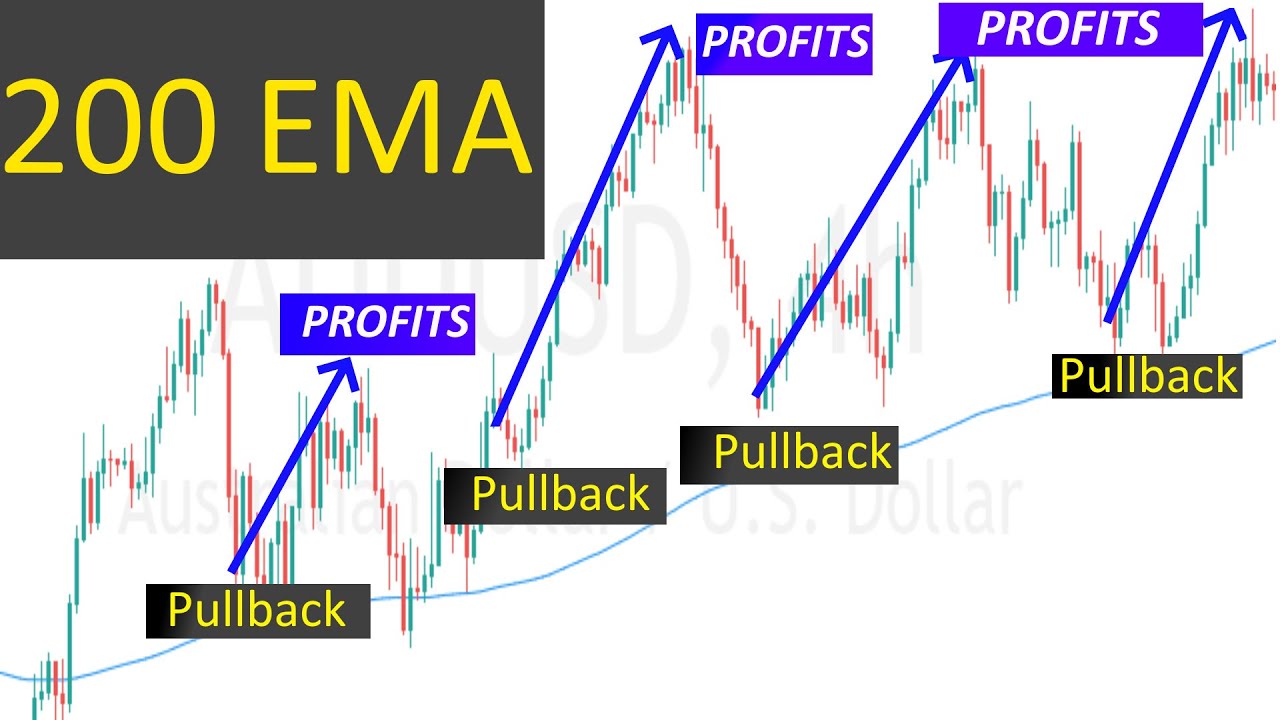

200 EMA Strategy Every Beginner Needs To Know

Latest updated videos about Day Trading, Trading Indicators, Forex Trading School, and What Is an Ema in Forex, 200 EMA Strategy Every Beginner Needs To Know.

200 EMA Strategy Every Beginner Needs to Know! Interesting thing about this 200 EMA Strategy is that anyone can easily comprehend it even if you’re a …

What Is an Ema in Forex, 200 EMA Strategy Every Beginner Needs To Know.

Trend Trading – Trading Stocks Utilizing Technical Analysis And Swing Trading Strategies

They suppose that is how rewarding traders make their money. The SPX day-to-day chart listed below programs an orderly pullback in August. In lots of instances we can, but ONLY if the volume boosts.

200 EMA Strategy Every Beginner Needs To Know, Find more high definition online streaming videos about What Is an Ema in Forex.

What It Takes To Be A Day Trading Expert

3) Day trading suggests quick earnings, do not hold stock for more than 25 min. They do not understand proper trading techniques. This implies that you need to understand how to manage the trade prior to you take an entry.

Moving averages are preferred indications in the forex. Most traders use them, and some people use them entirely as their own indication. However what is the function of moving averages, and how do you in fact make money from them?

The down trend in sugar futures is well established due to the expectations of a huge 2013 harvest that need to be led by a record Brazilian harvest. This is news that everyone understands and this basic information has drawn in great traders to the sell side of the marketplace. Technical traders have likewise had a simple go of it since what rallies there have been have been capped perfectly by the 90 day moving average. In reality, the last time the 30-day Moving Average Trader average crossed under the 90-day moving average remained in August of last year. Finally, technical traders on the short side have gathered profits due to the orderly decline of the market so far rather than getting stopped out on any spikes in volatility.

There are a number of possible explanations for this. The very first and most apparent is that I was simply setting the stops too close. This might have enabled the random “sound” of the price movements to activate my stops. Another possibility is that either my broker’s dealing desk or some other heavy player in the market was taking part in “stop searching”. I’ve composed a more total post on this subject already, however essentially this includes market gamers who attempt to push the price to a point where they think a lot of stop loss orders will be activated. They do this so that they can either enter the market at a much better rate on their own or to trigger a cumulative move in an instructions that benefits their current positions.

In the middle of this terrible experience, her 12 years of age child got back from School and found her mother in tears. “What’s wrong Forex MA Trading?” her child asked. “Oh, this option trading will be the death of me beloved,” Sidney sobbed.

Now that you have actually identified the daily trend, drop down to the lower timeframe and look at the Bollinger bands. You are looking for the Stocks MA Trading rate to strike the extreme band that is versus the day-to-day pattern.

The most utilized MA figures consist of the 20 Day MA, the 50 Day MA and the 200 Day MA. The 20 Day MA takes a look at the short-term average, the 50 Day looks that a more intermediate amount of time and the 200 Day looks at a longer time frame. When the security is over their moving average, the entire function for this strategy is to only be invested. It is perfect when it is over all 3 averages, but that typically isn’t the case. To keep dangers down, I recommend simply going with the 200 Day Moving Typical.

It has actually been quite a couple of weeks of disadvantage volatility. The rate has dropped some $70 from the peak of the last go to $990. The green line portrays the major fight area for $1,000. While it is $990 instead of $1,000 it does represent that turning point. Therefore we have had our 2nd test of the $1,000 according to this chart.

Now, this extremely crucial if you alter the variety of periods of the simple moving average, you should alter the basic deviation of the bands also. For example if you increase the period to 50, increase the basic discrepancy to 2 and a half and if you reduce the period to 10, reduce the standard variance to one and a half. Durations less than 10 do not seem to work well. 20 or 21 period is the ideal setting.

Moving averages – These are like trend lines, other than that they lessen and stream with the price of the instrument. In this action, you might increase your cash and gold allowances even more. You desire to generate income in the forex, right?

If you are looking instant exciting videos about What Is an Ema in Forex, and Trading Info, Stock Trading Course dont forget to list your email address for email alerts service totally free.