SMA Vs. EMA. What are the Differences and How Can I Set Them Up?

Interesting full length videos top searched Forex Beginners – 2 Extremely Popular Indicators and How to Use Them, Forex Investors, Best Forex, Best Forex System, and Sma Vs Ema Swing Trading, SMA Vs. EMA. What are the Differences and How Can I Set Them Up?.

My Course On Options just launched sign up here: https://www.rocketoptionu.com/

Get 10% off for the first 500 students: STEVETRADES

I am not a financial advisor. Please take everything in this course for entertainment & educational purposes only

Sma Vs Ema Swing Trading, SMA Vs. EMA. What are the Differences and How Can I Set Them Up?.

Forex Trading System – Following The Trend

I discover that the BI typically exposes the bias of a stock for the day. When picking a trading system, it is required to think about the frequency of trades. Some people desire to make trading so difficult.

SMA Vs. EMA. What are the Differences and How Can I Set Them Up?, Watch popular high definition online streaming videos related to Sma Vs Ema Swing Trading.

Professional Forex Trading Techniques – Professional Guide

Presently, SPX is oversold enough to bounce into the Labor Day vacation. Nasdaq has rallied 310 points in three months, and struck a brand-new four-year high at 2,201 Fri morning. Likewise active trading can affect your tax rates.

The Bollinger Bands were created by John Bollinger in the late 1980s. Bollinger studied moving averages and experimented with a brand-new envelope (channel) sign. This research study was among the first to determine volatility as a dynamic movement. This tool provides a relative meaning of rate highs/lows in regards to upper and lower bands.

Out of all the stock trading pointers that I’ve been offered over the ears, bone assisted me on a more practical level than these. Moving Average Trader Use them and use them well.

Once the trend is broken, get out of your trade! Cut your losses, and let the long trips offset these small losses. Once the pattern has been restored, you can re-enter your trade.

In the middle of this horrible experience, her 12 year old child came home from School and found her mother in tears. “What’s wrong Forex MA Trading?” her child asked. “Oh, this choice trading will be the death of me beloved,” Sidney sobbed.

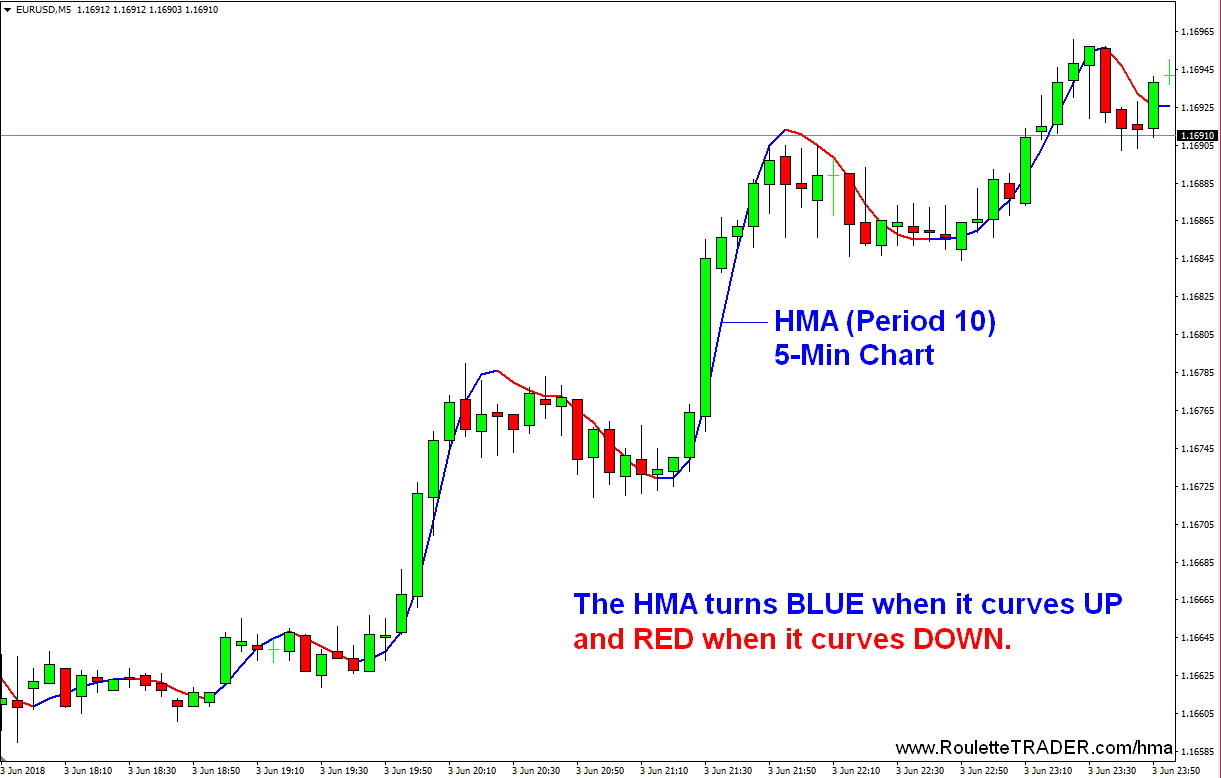

Considering that we are utilizing historical data, it is worth keeping in mind that moving averages are ‘lag Stocks MA Trading indicators’ and follow the real period the higher the responsiveness of the chart and the close it is to the actual rate line.

Another forex trader does care excessive about getting a roi and experiences a loss. This trader loses and his wins are on average, much larger than losing. He wins double what was lost when he wins the game. This shows a balancing in losing and winning and keeps the investments open to get a revenue at a later time.

Stochastics is used to identify whether the market is overbought or oversold. The market is overbought when it reaches the resistance and it is oversold when it reaches the assistance. So when you are trading a variety, stochastics is the very best indication to inform you when it is overbought or oversold. It is also called a Momentum Indication!

Keep in mind, the secret to understanding when to purchase and offer stocks is to be constant in using your guidelines and comprehending that they will not work whenever, however it’s a whole lot better than not having any system at all.

Nasdaq has been creating an increasing wedge for about 2 years. By doing this, you wont need to fret about losing money whenever you trade. You wish to earn money in the forex, right?

If you are finding best ever entertaining reviews relevant with Sma Vs Ema Swing Trading, and Day Moving Average, Accurate Forex Signals you are requested to signup our email list now.