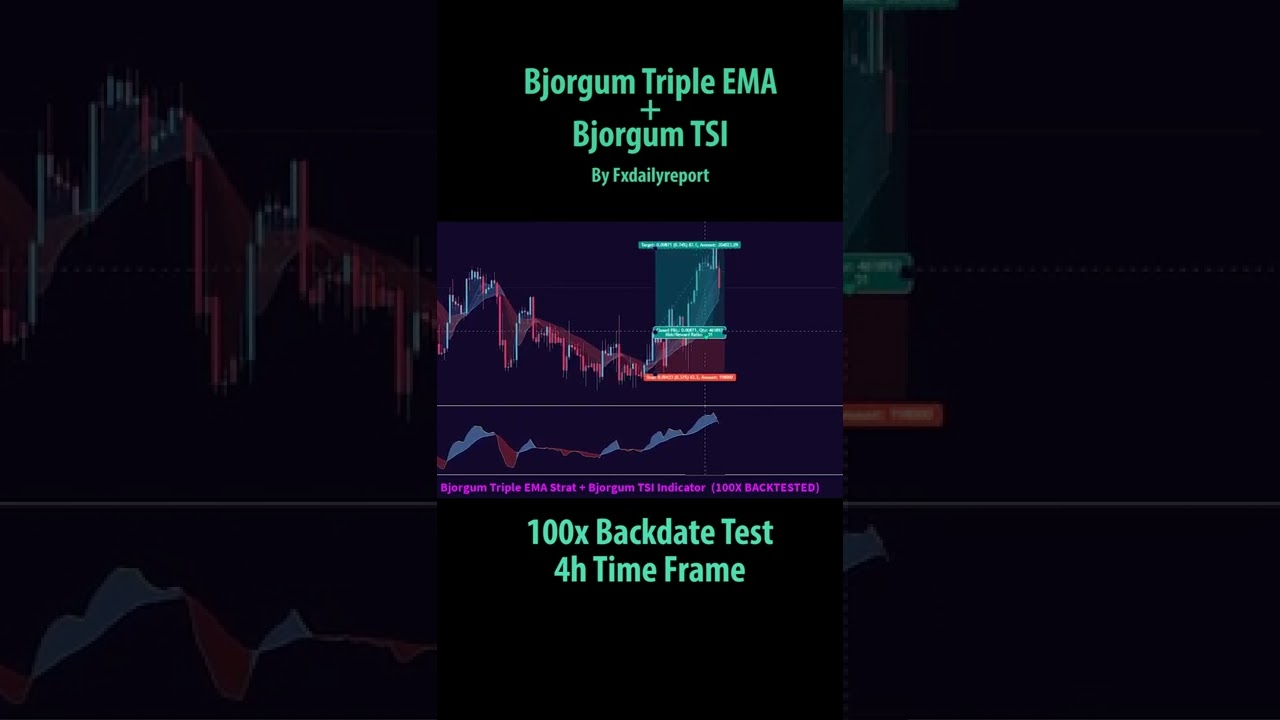

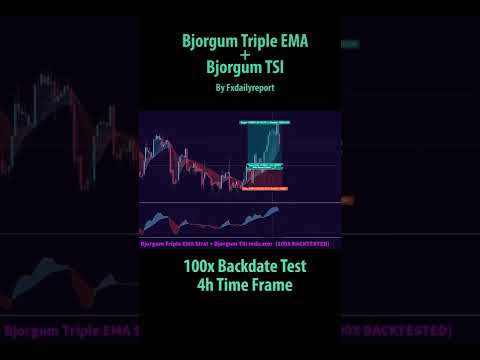

Shorts Bjorgum Triple EMA + Bjorgum TSI Forex Trading

Interesting full length videos highly rated Oil Stocks, Chinese Markets, Swing Trading Basics, and What Is an Ema in Forex, Shorts Bjorgum Triple EMA + Bjorgum TSI Forex Trading.

#shorts

What Is an Ema in Forex, Shorts Bjorgum Triple EMA + Bjorgum TSI Forex Trading.

Using Moving Averages To Your Forex Trading Profit

Well, if a powerful relocation is underway, then the price is moving away from the average, and the bands broaden. Just be there in the ideal time and with best order. Now that you’ve tallied the points, what does it mean?

Shorts Bjorgum Triple EMA + Bjorgum TSI Forex Trading, Get interesting replays relevant with What Is an Ema in Forex.

Stochastic System – A Swing Trading Stochastics System For Big Gains

Support and resistance are levels that the market reaches prior to it turns around. Those 3 things are the structure for an excellent trading system. They expect that is how profitable traders make their cash.

Everyone wishes to find out currency trading, or so it appears from the variety of individuals being drawn into the foreign currency, or forex, craze. However, as with many things, there’s a right way and a wrong way. And the right method has three vital ingredients.

Using the same 5% stop, our trading system went from losing practically $10,000 to gaining $4635.26 over the exact same ten years of data! The performance is now a favorable 9.27%. There were 142 profitable trades with 198 unprofitable trades with the Moving Average Trader earnings being $175.92 and typical loss being $102.76. Now we have a better trading system!

Assistance & Resistance. Support-this term explains the bottom of a stock’s trading variety. It’s like a flooring that a stock rate finds it hard to penetrate through. Resistance-this term describes the top of a stock’s trading range.It’s like a ceiling which a stock’s price doesn’t appear to increase above. When to purchase or offer a stock, assistance and resistance levels are necessary clues as to. Lots of successful traders buy a stock at assistance levels and offer brief stock at resistance. If a stock manages to break through resistance it might go much higher, and if a stock breaks its support it might indicate a breakdown of the stock, and it may decrease much even more.

The chart below is a Nasdaq weekly chart. Nasdaq has actually been producing an increasing wedge for about two years. The Forex MA Trading sign has been moving in the opposite instructions of the price chart (i.e. unfavorable divergence). The three highs in the wedge fit well. Nevertheless, it doubts if the third low will likewise provide a good fit. The wedge is compressing, which must continue to produce volatility. Numerous intermediate-term technical indicators, e.g. NYSE Summation Index, NYSE Oscillator MAs, CBOE Put/Call, etc., recommend the market will be greater sometime within the next couple of months.

Let us state that we wish to make a short-term trade, in between 1-10 days. Do a screen for Stocks MA Trading in a new up pattern. Bring up the chart of the stock you are interested in and bring up the 4 and 9 day moving average. When the for 4 day crosses over the 9 day moving average the stock is going to continue up and need to be purchased. However as soon as the 9 day crosses over the 4 day it is a sell signal. It is that easy.

At its core your FOREX trading system requires to be able to spot patterns early and also have the ability to avoid sharp rises or falls due to an especially unstable market. In the beginning glimpse this may appear like a challenging thing to achieve and to be truthful no FOREX trading system will carry out both functions flawlessly 100% of the time. Nevertheless, what we can do is create a trading system that works for the huge bulk of the time – this is what we’ll concentrate on when developing our own FOREX trading system.

I have actually discussed this several times, but I believe it deserves discussing once again. The most typical moving average is the 200-day SMA (basic moving average). Extremely basically, when the marketplace is above the 200-day SMA, traders state that the marketplace remains in an uptrend. When price is listed below the 200-day SMA, the marketplace remains in a sag.

Integrating these two moving averages gives you a great foundation for any trading strategy. Chances are excellent that you will be able to make money if you wait for the 10-day EMA to agree with the 200-day SMA. Simply utilize good finance, do not risk excessive on each trade, and you ought to be great.

A 50-day moving average line takes 10 weeks of closing rate data, and then plots the average. The huge issue with this method is that ‘incorrect signals’ might happen typically.

If you are looking rare and engaging comparisons related to What Is an Ema in Forex, and Forex Indicator Systems, Forex Education you are requested to join our newsletter for free.