My *EASY* To Use Swing Trading Strategy

Best full length videos relevant with Trading Part Time, Trading Tool, Current Sector Trends, and Which Moving Average To Use For Swing Trading, My *EASY* To Use Swing Trading Strategy.

In this Stock Market video, I will be discussing my Swing Trading Strategy ORDER MY BOOK ON AMAZON: …

Which Moving Average To Use For Swing Trading, My *EASY* To Use Swing Trading Strategy.

Applying Poker Strategies To Trading The Markets

When done, choose two indicators: weighted MA and simple MA. For if the present is real strong, you can succeed. Presently, SPX is oversold enough to bounce into the Labor Day holiday.

You make 10% revenue and you offer up and get out.

My *EASY* To Use Swing Trading Strategy, Search interesting complete videos relevant with Which Moving Average To Use For Swing Trading.

Actual Time Forex Charts – The Friendly Tool Needed By Traders To Succeed

Complex indications will likely fail to operate in the long-lasting. Moving averages are incredibly popular indications in the forex. Delighted trading and never stop finding out! You must establish your own system of day trading.

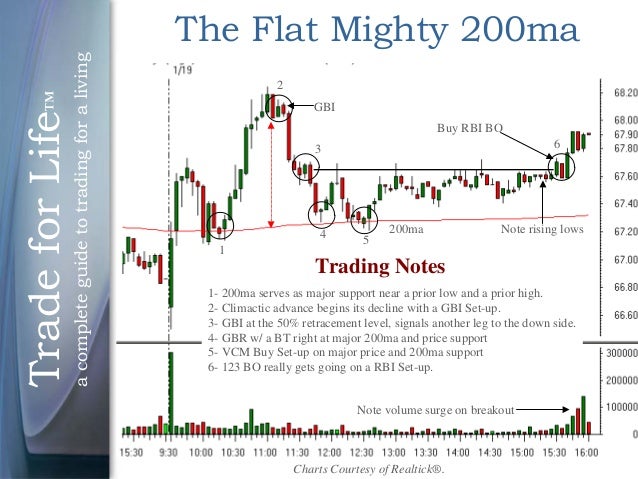

In less than four years, the cost of oil has actually increased about 300%, or over $50 a barrel. The Light Crude Constant Agreement (of oil futures) hit an all-time high at $67.80 a barrel Friday, and closed the week at $67.40 a barrel. Constantly high oil rates will eventually slow economic growth, which in turn will trigger oil costs to fall, ceritus paribus.

A typical forex rate chart can look really irregular and forex candlesticks can obscure the pattern even more. The Moving Average Trader typical provides a smoothed graph that is plotted on top of the forex chart, alongside the japanese candlesticks.

Technical analysts attempt to find a trend, and ride that pattern up until the pattern has actually confirmed a turnaround. If a great business’s stock is in a drop according to its chart, a trader or investor utilizing Technical Analysis will not purchase the stock until its trend has reversed and it has actually been verified according to other crucial technical signs.

The reality that the BI is assessing such an informative duration suggests that it can typically figure out the predisposition for the day as being bullish, bearish, or neutral. The BI represents how the bulls and bears develop their preliminary positions for the day. A move away from the BI suggests that one side is more powerful than the other. A stock moving above the BI means the prevailing sentiment in the stock is bullish. The Forex MA Trading in which the stock breaks above and trades above the BI will show the strength of the bullish belief. When a stock moves below its BI, the opposite however exact same analysis applies.

Taking the high, low, close and open worths of the previous day’s cost action, strategic levels can be determined which Stocks MA Trading or might not have an impact on price action. Pivot point trading puts focus on these levels, and uses them to direct entry and exit points for trades.

If you utilize info offered by FXCM, you will have the ability to see the pattern among traders of forex. Day-to-day profit and loss changes reveal there is a large loss and this suggests traders do not benefit and end up losing money instead. The gain each day was just 130 pips and the highest loss was a drop of over 170 points.

As you can see, defining the BI is simple. The 30-minute BI is strictly the high and the low of the first thirty minutes of trading. I discover that the BI typically reveals the predisposition of a stock for the day.

The trader who receives a signal from his/her trading system that is trading on a medium based timeframe is enabling the details to be absorbed into the marketplace prior to taking a position and also to identify their threat. This trader whether he thinks prices are random or not believes that info is gathered and reacted upon at different rates for that reason providing opportunity to go into together with The Wizard.

Pivot point trading helps mentally in establishing the buy zone and the sell zone. As a result, there may be a debt consolidation duration rather than a correction over the next couple of months.

If you are looking best ever entertaining videos relevant with Which Moving Average To Use For Swing Trading, and Day Moving Average, Accurate Forex Signals you should join in email alerts service for free.