How to interpret the MACD indicator | CA Rachana Ranade

Latest clips about Current Sector Trends, How to Read Stock Charts, and Best Ma Crossover Settings, How to interpret the MACD indicator | CA Rachana Ranade.

In this video, I have introduced a very important and useful indicator for swing trading, which I also personally use for my own trading. This indicator is a very good trend following indicator and can give us really good trades in trending markets. This indicator should be avoided during choppy markets. I have explained the concept and logic behind the indicator using real examples.

#Rachana Ranade #SwingTrading #StockMarket

#IndusIndBank #IndusIndBankcreditcards

Apply Now for IndusInd bank credit card – https://tinyurl.com/ym63tuda

What is covered?

00:00 – Introduction

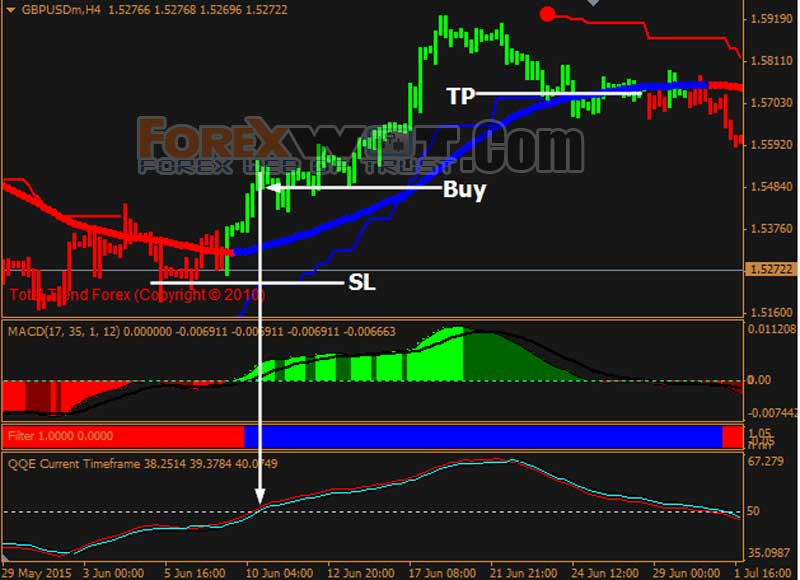

00:58 – What is the concept of MACD indicator?

02:51 – Explain MACD concept with a practical example?

14:15 – How to use MACD on chart

18:02 – Conclusion

Do you want to be a person who can confidently make your own investment decisions? If yes, check out our courses at: https://social.rachanaranade.com/Courses It’s an opportunity to learn a lot of concepts relating to Stock Market, Mutual Funds, F&O etc. in a systematic, simple and fun-filled manner! Feel free to WhatsApp on +91 9022196678 if you have any enrollment-related queries.

_____________________________________________________________________

Join my YouTube Memberships: https://bit.ly/JoinCARRYTMembership

_____________________________________________________________________

Facebook► https://social.rachanaranade.com/Facebook

Telegram ►https://social.rachanaranade.com/Telegram

Instagram► https://instagram.com/ca_rachanaranade?utm_medium=copy_link

Twitter► https://social.rachanaranade.com/twitter

LinkedIn► https://bit.ly/CARRLinkedin

———————————————————————————————————————–

Playlist:

Basics of Stock Market For Beginners: https://link.rachanaranade.com/BOSM

Best Ma Crossover Settings, How to interpret the MACD indicator | CA Rachana Ranade.

Assistance And Resistance In Cfd Trading

A 50-day moving typical line takes 10 weeks of closing cost information, and then plots the average.

However, similar to the majority of things, there’s an incorrect way and a best method.

How to interpret the MACD indicator | CA Rachana Ranade, Watch most shared complete videos about Best Ma Crossover Settings.

Rsi Reversals Are A Standalone Trading Signal For Finding Out Forex Successfully

Rapid MAs weigh more current rates heavier. A 50-day moving typical line takes 10 weeks of closing price data, and after that plots the average. This trader loses and his wins are on average, much larger than losing.

You must understand how to chart them if you trade stocks. Some individuals explore charts to discover buy or sell signals. I find this wasteful of a stock traders time. You can and need to chart all types of stocks consisting of penny stocks. When to offer or buy, charting tells you where you are on a stocks price pattern this implies it informs you. There are lots of great business out there, you don’t desire to get caught buying them at their 52 week high and needing to wait around while you hope the rate returns to the cost you paid.

Constantly use stop losses. You need to always safeguard your trades with a stop loss. If you are trading part time and you do not keep an eye on the market all day long, this is absolutely essential Moving Average Trader . If the trade does not go in your favour, it likewise assists to reduce your tension levels as you understand ahead how much you are most likely to loss.

The dictionary prices estimate a typical as “the quotient of any sum divided by the variety of its terms” so if you were exercising a 10 day moving average of the following 10, 20, 30, 40, 50, 60, 70, 80, 90, 100 you would include them together and divide them by 10, so the average would be 55.

There are Forex MA Trading theories on why this sell-off is taking place. Clearly, any genuine strength or perhaps support in the U.S. dollar will generally be bearish for rare-earth elements like gold and silver. This is mainly since the U.S. holds the largest stockpiles of these metals and they are sold U.S. dollars internationally. Even though gold is more of an acknowledged currency, they both have level of sensitivity to changes in the U.S. dollar’s value.

You have actually probably heard the expression that “booming Stocks MA Trading climb a wall of worry” – well there does not appear to be much of a wall of worry left anymore. A minimum of as far as the retail financier is worried.

When determining a trade’s suitability, the new short positions will have protective stops put fairly close to the market because danger should always be the number one consideration. Today’s action plainly revealed that the marketplace has actually lacked individuals going to develop brand-new short positions under 17.55. Markets always go to where the action is. The declining varieties integrated with this week’s turnaround bar lead me to believe that the next move is higher.

Understanding where to set your stop loss can be challenging – you want to restrict how much you might perhaps lose so you ‘d be tempted to set an extremely small variety, but at the same time you desire to enable short term fluctuates so that you don’t exit your position too early.

I know these pointers may sound standard. and they are. However you would be surprised how lots of traders abandon an excellent trading system because they feel they should be able to trade the system without any idea whatsoever. If you would only discover to trade in the best direction and exit the trade with revenues. your search for a rewarding Forex system would be over.

After each one opens, there are often big changes in the costs for a man hours. This is not done, particularly by newbies in the field. Some people wish to make trading so tough.

If you are looking most entertaining comparisons related to Best Ma Crossover Settings, and How to Trade Trends, Towards Successful Trading, Online Day Trading, How to Read Stock Charts please subscribe our email alerts service now.