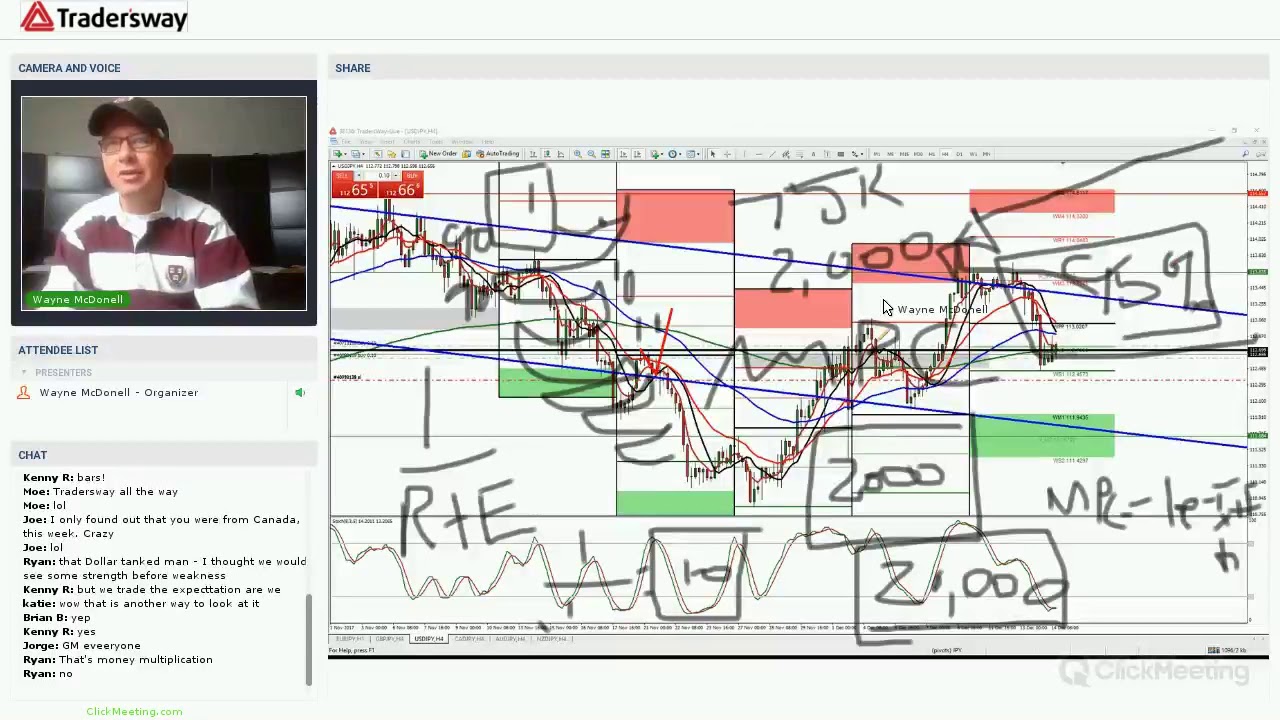

Forex Trading Strategy Webinar Video For Today: (LIVE Thursday December 14th, 2017)

Latest full videos highly rated Forex Beginners – 2 Extremely Popular Indicators and How to Use Them, Forex Investors, Best Forex, Best Forex System, and Sma Trading Egypt, Forex Trading Strategy Webinar Video For Today: (LIVE Thursday December 14th, 2017).

Watch our videos or attend our live events here: http://Forex.Today Daily Trading Strategy For Traders of the Foreign Currency …

Sma Trading Egypt, Forex Trading Strategy Webinar Video For Today: (LIVE Thursday December 14th, 2017).

Complimentary Day Trading System

We have to wait for a setup that assures an excellent return in a brief time. You will typically see cost respecting these lines and after that blowing right through them. And the proper way has three crucial components.

Forex Trading Strategy Webinar Video For Today: (LIVE Thursday December 14th, 2017), Watch latest reviews related to Sma Trading Egypt.

Day Trading In Your Birthday Suit

A typical forex cost chart can look really unpredictable and forex candlesticks can obscure the pattern even more. Those 3 things are the foundation for a good trading system. Make certain you end up being one of that minority.

Would not it be nice if you were only in the stock market when it was going up and have whatever moved to money while it is decreasing? It is called ‘market timing’ and your broker or monetary coordinator will inform you “it can’t be done”. What that individual just informed you is he doesn’t understand how to do it. He does not understand his task.

The down pattern in sugar futures is well founded due to the expectations of a substantial 2013 harvest that must be led by a record Brazilian harvest. This is news that everyone is mindful of and this basic details has drawn in good traders to the sell side of the market. Technical traders have also had a simple go of it because what rallies there have actually been have been capped well by the 90 day moving average. In fact, the last time the 30-day Moving Average Trader average crossed under the 90-day moving average was in August of in 2015. Lastly, technical traders on the brief side have gathered earnings due to the orderly decrease of the market so far instead of getting stopped out on any spikes in volatility.

Peter cautioned him nevertheless, “Remember Paul, not all trades are this simple and end up as well, however by trading these types of patterns on the daily chart, when the weekly pattern is likewise in the very same instructions, we have a high possibility of a profitable outcome in a large portion of cases.

Picking a timespan: If your day trading, purchasing and selling intra day, a 3 year chart will not help you. For intra day trading you wish to utilize 3,5 and 15 minute charts. Depending upon your longterm investment strategy you can take a look at a 1 year, which I utilize usually to a 10 year chart. The yearly chart give me a look at how the stock is doing now in today’s market. I’ll look longer for historical assistance and resistance points but will Forex MA Trading my buys and offers based upon what I see in front of me in the annual.

Follow your trading personality. What are your requirements? What are your objectives? Do the research, discover the Stocks MA Trading designs that fit your needs, determine which indications work for you and so on.

If you make 4 or more day sell a rolling five-trading-day duration, you will be thought about a pattern day trader no matter you have $25,000 or not. A day trading minimum equity call will be released on your account requiring you to deposit extra funds or securities if your account equity falls below $25,000.

I have actually discussed this numerous times, but I believe it deserves mentioning again. The most typical moving average is the 200-day SMA (basic moving average). Very put simply, when the market is above the 200-day SMA, traders say that the market is in an uptrend. When price is listed below the 200-day SMA, the marketplace remains in a downtrend.

The basic rule in trading with the Stochastics is that when the reading is above 80%, it implies that the market is overbought and is ripe for a down correction. Likewise when the reading is below 20%, it indicates that the market is oversold and is going to bounce down soon!

My point is this – it does not truly matter which one you utilize. Long as the stock holds above that breakout level. Technical analysis can be very helpful for traders to time our entries and exits of the trade.

If you are searching rare and entertaining videos relevant with Sma Trading Egypt, and Commitment of Traders, Disciplined Trader, Stock Tips please join in email alerts service for free.